- United States

- /

- Oil and Gas

- /

- NasdaqCM:IMPP

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. market looks to rebound from a late-2024 slump, major indices like the S&P 500 and Nasdaq Composite have started 2025 with slight gains, hinting at potential recovery. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities despite being considered a throwback term. By focusing on those with strong financials and clear growth prospects, investors can uncover hidden value in these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $5.59M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.67M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $91.3M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $84.54M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Equillium (NasdaqCM:EQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Equillium, Inc. is a clinical-stage biotechnology company focused on developing and selling products for severe autoimmune and immuno-inflammatory disorders with unmet medical needs, with a market cap of $26.51 million.

Operations: Equillium generates revenue from its Pharmaceuticals segment, totaling $45.91 million.

Market Cap: $26.51M

Equillium, Inc., with a market cap of US$26.51 million, is navigating challenges typical of penny stocks in the biotech sector. Despite generating US$45.91 million in revenue from its Pharmaceuticals segment, it remains unprofitable and faces potential delisting from Nasdaq due to a sustained low share price. The company has no debt and maintains sufficient cash runway for over a year under stable conditions, but it must address its volatile share price and declining earnings forecast to secure long-term viability. Recent board changes reflect ongoing strategic adjustments as Equillium seeks to stabilize its financial position.

- Jump into the full analysis health report here for a deeper understanding of Equillium.

- Evaluate Equillium's prospects by accessing our earnings growth report.

Imperial Petroleum (NasdaqCM:IMPP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imperial Petroleum Inc. offers international seaborne transportation services to oil producers, refineries, and commodities traders with a market cap of $91.30 million.

Operations: The company's revenue is derived from its transportation - shipping segment, which generated $151.15 million.

Market Cap: $91.3M

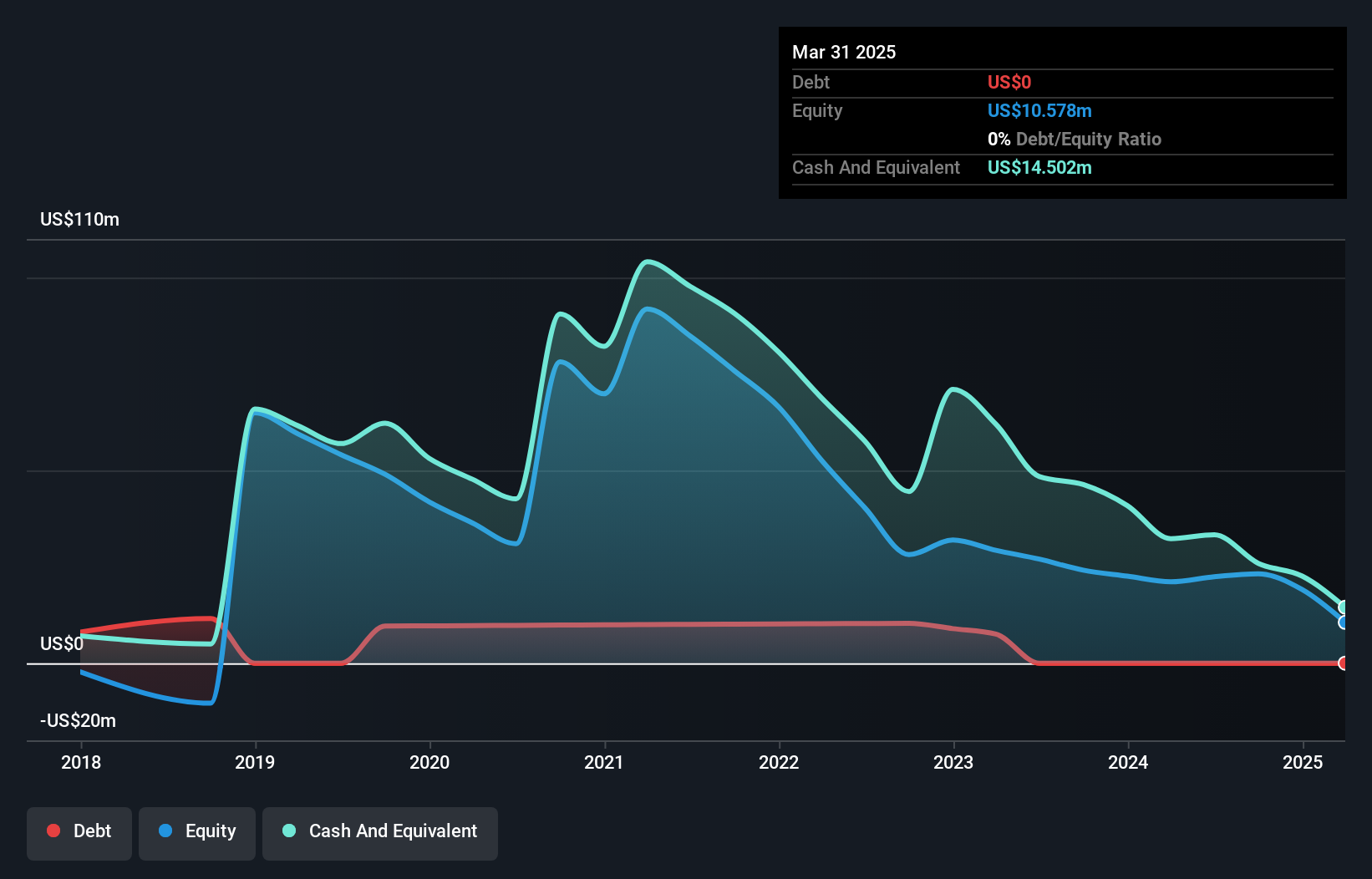

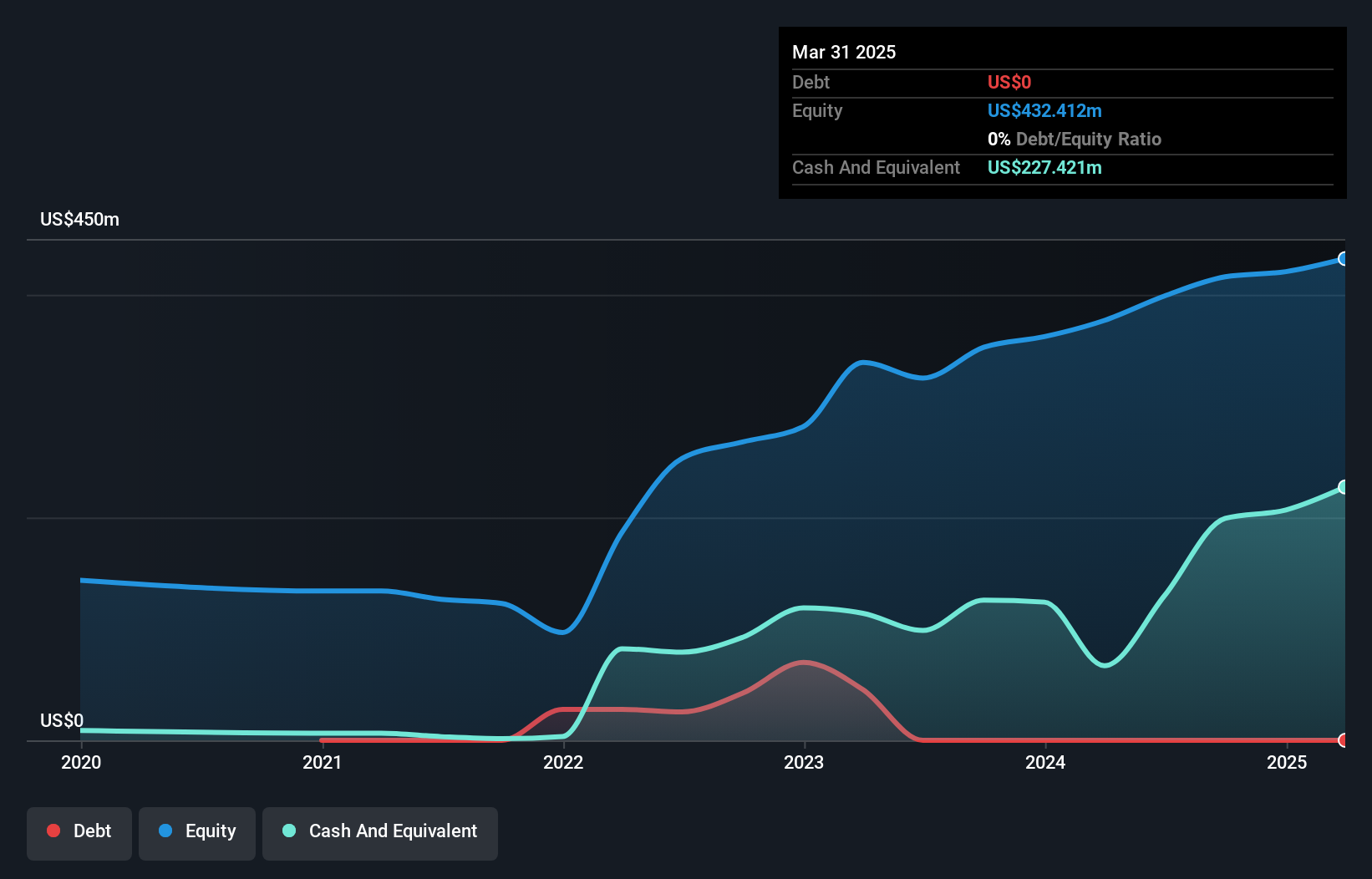

Imperial Petroleum Inc., with a market cap of US$91.30 million, shows the complexities of investing in penny stocks within the shipping industry. Despite significant revenue generation of US$151.15 million from its transportation segment, recent earnings have declined compared to last year, impacting profit margins and net income. The company benefits from a strong balance sheet with short-term assets exceeding liabilities and no debt burden, enhancing financial stability. However, negative earnings growth over the past year contrasts sharply with its five-year performance trend, highlighting volatility typical in this sector. Recent dividend announcements underscore efforts to maintain shareholder value amidst fluctuating earnings results.

- Dive into the specifics of Imperial Petroleum here with our thorough balance sheet health report.

- Understand Imperial Petroleum's earnings outlook by examining our growth report.

Relmada Therapeutics (NasdaqGS:RLMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Relmada Therapeutics, Inc. is a clinical-stage biotechnology company that develops products for treating central nervous system diseases and other disorders in the United States, with a market cap of $15.69 million.

Operations: No revenue segments are reported for this clinical-stage biotechnology company.

Market Cap: $15.69M

Relmada Therapeutics, Inc., with a market cap of US$15.69 million, exemplifies the challenges inherent in penny stocks within the biotech sector. As a pre-revenue company, it remains unprofitable and is exploring strategic alternatives to enhance shareholder value following setbacks in its Phase 3 studies. The firm has no debt and maintains sufficient short-term assets to cover liabilities. Despite having less than a year of cash runway if cash flow continues to decrease, Relmada's seasoned management team and ongoing development efforts in metabolic disease treatments could offer potential future opportunities amidst current volatility.

- Click to explore a detailed breakdown of our findings in Relmada Therapeutics' financial health report.

- Explore Relmada Therapeutics' analyst forecasts in our growth report.

Seize The Opportunity

- Take a closer look at our US Penny Stocks list of 735 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMPP

Flawless balance sheet and undervalued.

Market Insights

Community Narratives