- United States

- /

- Biotech

- /

- NasdaqGS:ENTA

Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) Shares Fly 27% But Investors Aren't Buying For Growth

Despite an already strong run, Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) shares have been powering on, with a gain of 27% in the last thirty days. But the last month did very little to improve the 67% share price decline over the last year.

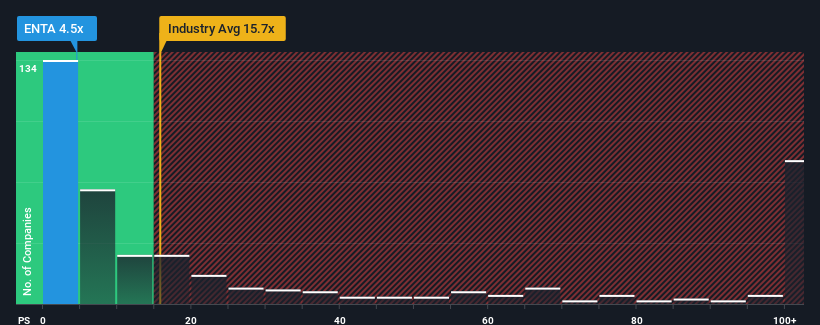

In spite of the firm bounce in price, Enanta Pharmaceuticals may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.7x and even P/S higher than 76x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Enanta Pharmaceuticals

How Enanta Pharmaceuticals Has Been Performing

Enanta Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Enanta Pharmaceuticals will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Enanta Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. As a result, revenue from three years ago have also fallen 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 0.6% per year over the next three years. With the industry predicted to deliver 265% growth each year, that's a disappointing outcome.

With this information, we are not surprised that Enanta Pharmaceuticals is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Enanta Pharmaceuticals' P/S Mean For Investors?

Even after such a strong price move, Enanta Pharmaceuticals' P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Enanta Pharmaceuticals' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Enanta Pharmaceuticals' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Enanta Pharmaceuticals you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Enanta Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ENTA

Enanta Pharmaceuticals

A biotechnology company, discovers and develops small molecule drugs for the treatment of viral infections and liver diseases.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives