- United States

- /

- Biotech

- /

- NasdaqCM:EDSA

Companies Like Edesa Biotech (NASDAQ:EDSA) Can Afford To Invest In Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Edesa Biotech (NASDAQ:EDSA) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Edesa Biotech

When Might Edesa Biotech Run Out Of Money?

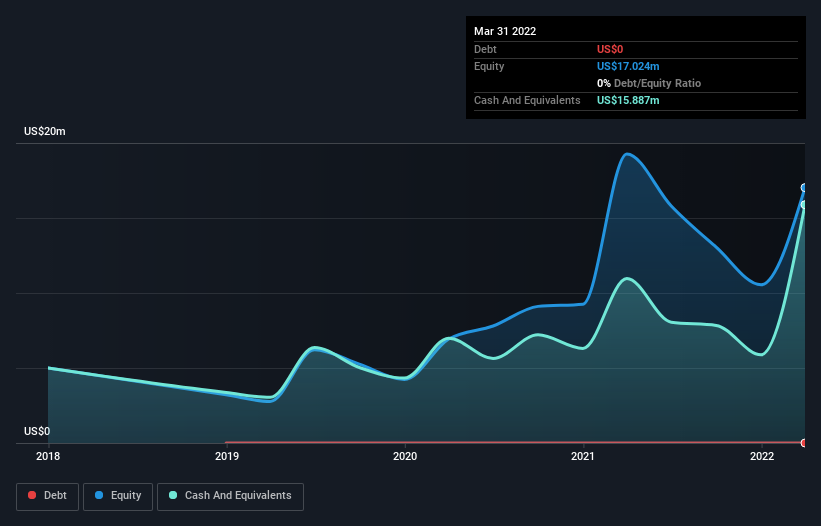

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2022, Edesa Biotech had US$16m in cash, and was debt-free. Importantly, its cash burn was US$7.1m over the trailing twelve months. So it had a cash runway of about 2.2 years from March 2022. Importantly, though, analysts think that Edesa Biotech will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

How Is Edesa Biotech's Cash Burn Changing Over Time?

In our view, Edesa Biotech doesn't yet produce significant amounts of operating revenue, since it reported just US$500 in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Even though it doesn't get us excited, the 46% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Edesa Biotech Raise Cash?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Edesa Biotech to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Edesa Biotech has a market capitalisation of US$34m and burnt through US$7.1m last year, which is 21% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About Edesa Biotech's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Edesa Biotech is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While its cash burn relative to its market cap wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Edesa Biotech (2 are concerning!) that you should be aware of before investing here.

Of course Edesa Biotech may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Edesa Biotech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Edesa Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EDSA

Edesa Biotech

A clinical-stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases.

Flawless balance sheet moderate.

Market Insights

Community Narratives