- United States

- /

- Biotech

- /

- NasdaqGS:EDIT

Editas Medicine, Inc.'s (NASDAQ:EDIT) Price Is Right But Growth Is Lacking After Shares Rocket 28%

Editas Medicine, Inc. (NASDAQ:EDIT) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 70% share price drop in the last twelve months.

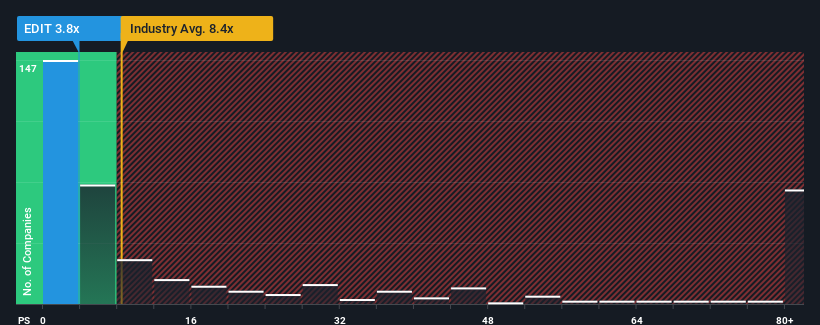

Although its price has surged higher, Editas Medicine may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.4x and even P/S higher than 46x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in Editas Medicine. Read for free now.See our latest analysis for Editas Medicine

What Does Editas Medicine's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Editas Medicine's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Editas Medicine.How Is Editas Medicine's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Editas Medicine's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 30% per year over the next three years. With the industry predicted to deliver 162% growth each year, that's a disappointing outcome.

With this information, we are not surprised that Editas Medicine is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Even after such a strong price move, Editas Medicine's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Editas Medicine's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Editas Medicine's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Editas Medicine that we have uncovered.

If you're unsure about the strength of Editas Medicine's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Editas Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EDIT

Editas Medicine

A clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives