- United States

- /

- Biotech

- /

- NasdaqGS:EDIT

Editas Medicine, Inc. (NASDAQ:EDIT) Surges 28% Yet Its Low P/S Is No Reason For Excitement

Those holding Editas Medicine, Inc. (NASDAQ:EDIT) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

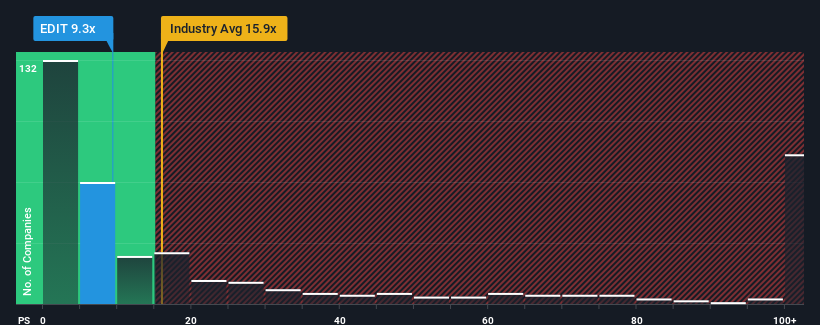

Even after such a large jump in price, Editas Medicine may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 9.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.9x and even P/S higher than 75x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Editas Medicine

How Editas Medicine Has Been Performing

With revenue growth that's superior to most other companies of late, Editas Medicine has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Editas Medicine's future stacks up against the industry? In that case, our free report is a great place to start.How Is Editas Medicine's Revenue Growth Trending?

In order to justify its P/S ratio, Editas Medicine would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 14% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 6.0% per annum as estimated by the analysts watching the company. That's not great when the rest of the industry is expected to grow by 270% each year.

With this in consideration, we find it intriguing that Editas Medicine's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Editas Medicine's P/S

Despite Editas Medicine's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Editas Medicine maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Editas Medicine that you should be aware of.

If these risks are making you reconsider your opinion on Editas Medicine, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Editas Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EDIT

Editas Medicine

A clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives