- United States

- /

- IT

- /

- OTCPK:URLO.F

Top US Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the U.S. equities market looks to rebound from last week's downturn, investors are keenly watching for opportunities amidst the shifting landscape. Penny stocks, a term that harks back to earlier days of trading, continue to offer intriguing possibilities for those interested in smaller or newer companies. Despite their modest price points, these stocks can represent significant growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8379 | $6.09M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.69 | $2.15B | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.58M | ★★★★☆☆ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.22 | $529.41M | ★★★★★★ |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.20 | $29.91M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.33M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.71 | $139.05M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.942 | $84.72M | ★★★★★☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Dyadic International (NasdaqCM:DYAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dyadic International, Inc. is a biotechnology platform company that develops, produces, and sells enzymes and other proteins both in the United States and internationally, with a market cap of $33.31 million.

Operations: No specific revenue segments are reported for this biotechnology platform company that operates in the United States and internationally.

Market Cap: $33.31M

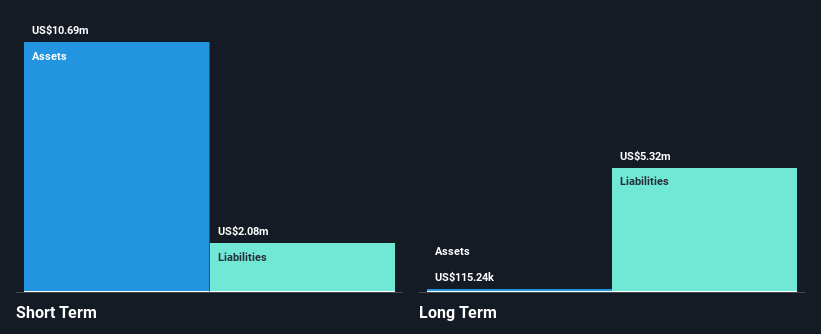

Dyadic International, Inc., with a market cap of US$33.31 million, has shown significant revenue growth, reporting US$1.96 million for Q3 2024 compared to US$0.40 million the prior year. Despite being currently unprofitable and having a negative return on equity, the company has reduced its net loss from US$1.61 million to US$0.20 million over the same period. Dyadic's short-term assets cover both its short- and long-term liabilities comfortably, and it maintains more cash than debt, providing financial stability as it continues to develop its biotechnology platform internationally. However, shareholder dilution remains a concern with increased shares outstanding recently.

- Click here to discover the nuances of Dyadic International with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Dyadic International's future.

Tecogen (OTCPK:TGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tecogen Inc. designs, manufactures, markets, and maintains ultra-clean cogeneration products for various sectors primarily in the United States with a market cap of approximately $22.86 million.

Operations: Tecogen Inc. has not reported specific revenue segments for its operations.

Market Cap: $22.86M

Tecogen Inc., with a market cap of US$22.86 million, reported Q3 2024 revenue of US$5.63 million, down from US$7.11 million the previous year, and a net loss of US$0.93 million, reflecting ongoing unprofitability and increasing losses over five years at 0.3% annually. Despite this, Tecogen's short-term assets exceed its liabilities, indicating solid liquidity management with no significant shareholder dilution recently observed. The company's debt to equity ratio remains satisfactory at 2.2%, though it has increased over time from 3.9% to 13.7%. Its experienced management team supports operational stability amid financial challenges.

- Unlock comprehensive insights into our analysis of Tecogen stock in this financial health report.

- Examine Tecogen's past performance report to understand how it has performed in prior years.

NameSilo Technologies (OTCPK:URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp., with a market cap of $27.66 million, operates through its subsidiaries to offer domain name registration services across Canada, the United States, East and South Asia, South East Asia, Australasia, and other international markets.

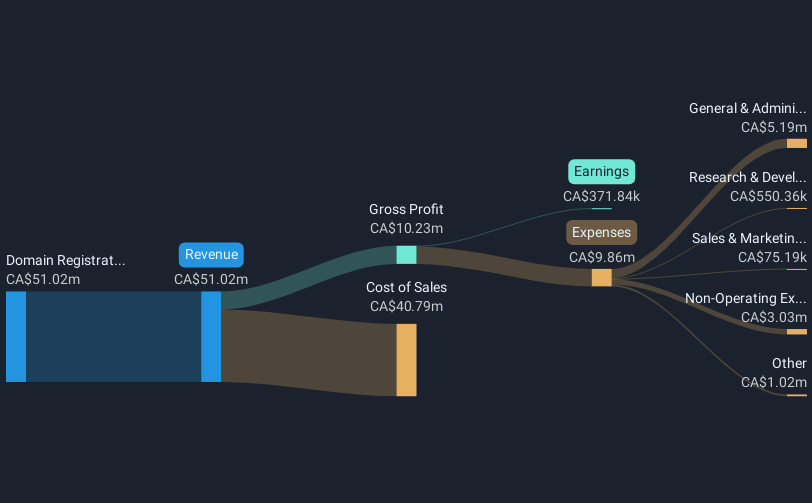

Operations: The company generates CA$51.02 million in revenue from domain registration and related services.

Market Cap: $27.66M

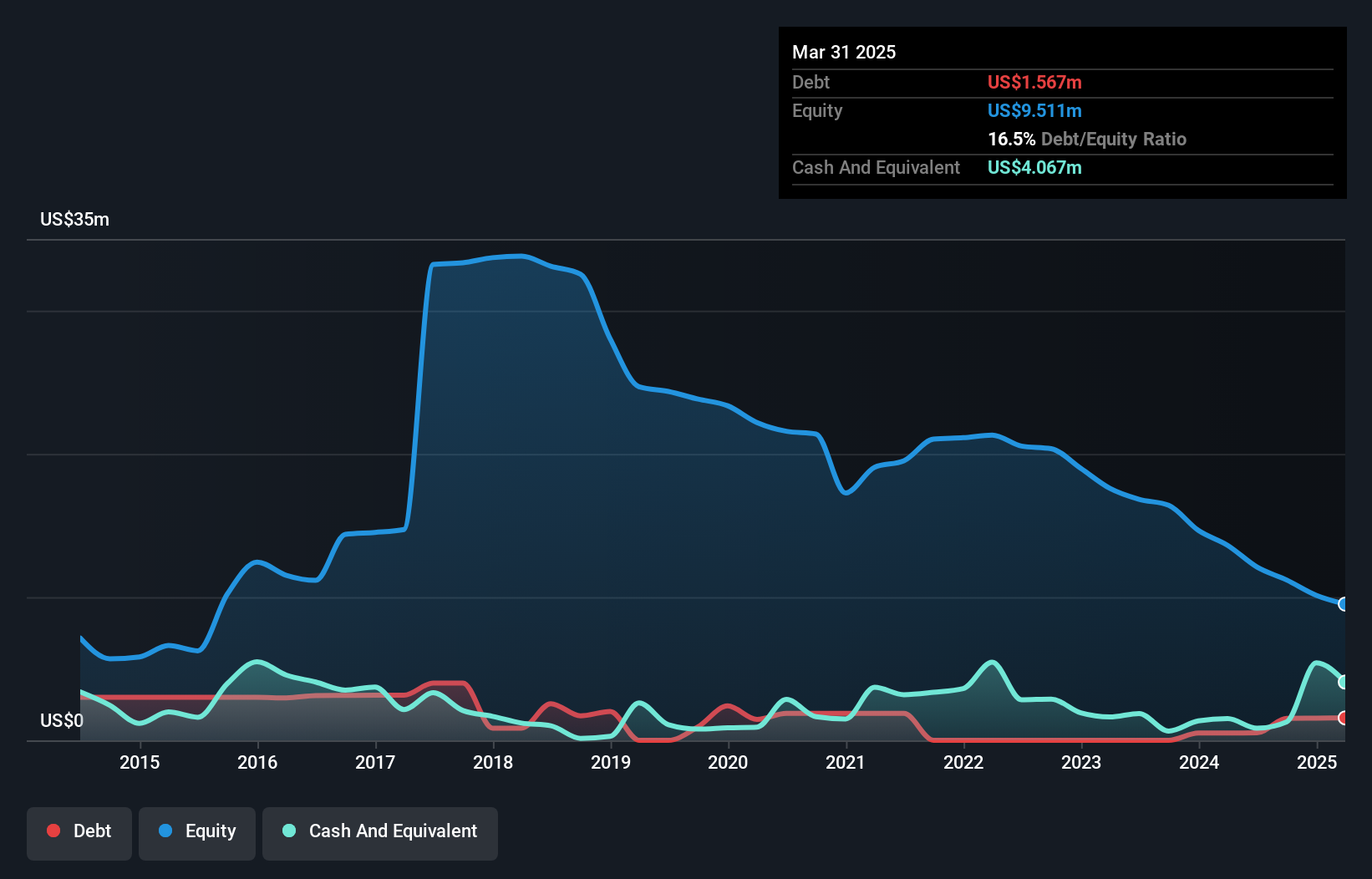

NameSilo Technologies Corp., with a market cap of $27.66 million, has shown resilience in the penny stock domain by repaying a $3.9 million loan early, leveraging free cash flow and securing additional financing from Pathfinder Partners' Fund. The company's revenue of CA$51.02 million from domain registration highlights its operational strength, though recent earnings were impacted by a large one-off loss of CA$1.1 million. Despite this, NameSilo became profitable over the past year and maintains satisfactory debt levels with strong operating cash flow coverage. Its seasoned management team further supports strategic stability amidst high share price volatility.

- Get an in-depth perspective on NameSilo Technologies' performance by reading our balance sheet health report here.

- Learn about NameSilo Technologies' historical performance here.

Turning Ideas Into Actions

- Unlock more gems! Our US Penny Stocks screener has unearthed 745 more companies for you to explore.Click here to unveil our expertly curated list of 748 US Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NameSilo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:URLO.F

NameSilo Technologies

Through its subsidiaries, provides domain name registration services in Canada, the United States, East and South Asia, South East Asia, Australasia, and internationally.

Excellent balance sheet and fair value.