- United States

- /

- Biotech

- /

- NasdaqCM:DYAI

Dyadic International's (NASDAQ:DYAI) Wonderful 318% Share Price Increase Shows How Capitalism Can Build Wealth

The Dyadic International, Inc. (NASDAQ:DYAI) share price has had a bad week, falling 11%. But that doesn't displace its brilliant performance over three years. Over that time, we've been excited to watch the share price climb an impressive 318%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The share price action could signify that the business itself is dramatically improved, in that time.

See our latest analysis for Dyadic International

We don't think Dyadic International's revenue of US$1,689,172 is enough to establish significant demand. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Dyadic International has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Dyadic International investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

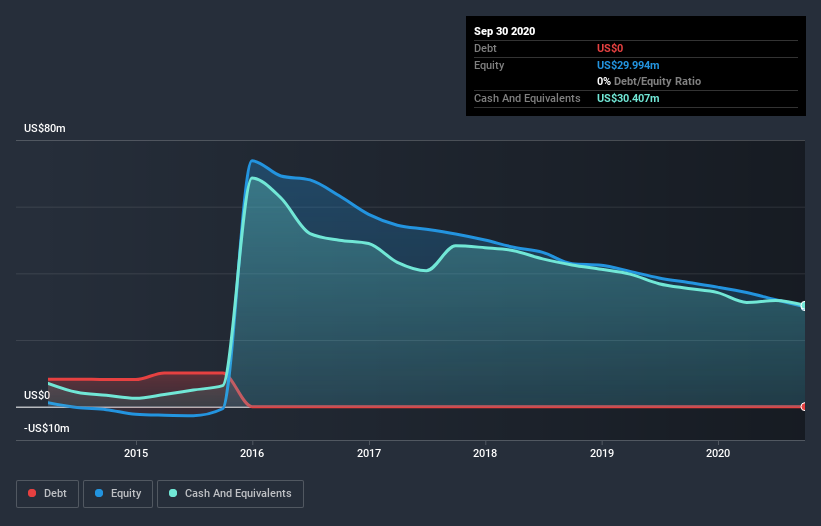

Dyadic International has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$29m, when it last reported (September 2020). This gives management the flexibility to drive business growth, without worrying too much about cash reserves. And with the share price up 57% per year, over 3 years , the market is focussed on that blue sky potential. You can see in the image below, how Dyadic International's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

Dyadic International shareholders are up 10% for the year. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 30% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Dyadic International better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Dyadic International you should be aware of, and 1 of them shouldn't be ignored.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Dyadic International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:DYAI

Dyadic International

A biotechnology platform company, develops, produces, and sells industrial enzymes and other proteins in the United States and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives