- United States

- /

- Biotech

- /

- NasdaqGS:DVAX

Dynavax Technologies (DVAX): Evaluating Valuation After CDC Panel Delays MMRV Vaccine for Young Children

Reviewed by Kshitija Bhandaru

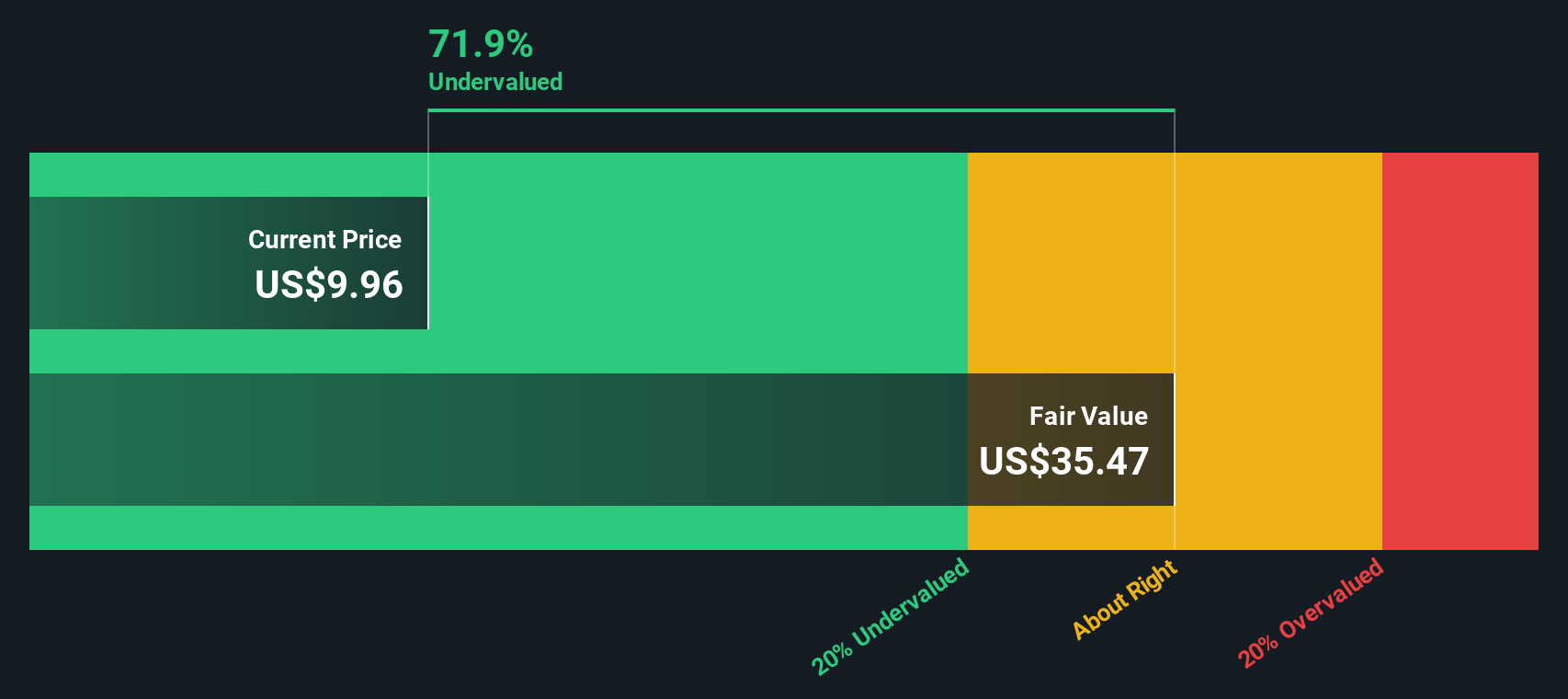

Most Popular Narrative: 57.5% Undervalued

The most widely followed narrative values Dynavax as significantly undervalued, indicating a large gap between its current share price and what analysts believe is its fair value.

The expansion of the U.S. adult hepatitis B vaccine market, accelerated by the ACIP universal recommendation and demographic shifts (such as an aging population and higher vaccination rates), supports expectations for sustained double-digit annual revenue growth for HEPLISAV-B through 2030 and beyond. Recent Medicare policy changes enabling direct HEPLISAV-B reimbursement for patients over 65 in retail settings are expanding the addressable market and improving product accessibility. This is expected to drive higher sales volumes and positively impact net revenue growth and margins.

Curious about the case behind this bold valuation? The big story: analysts believe explosive growth, margin leaps, and a prized profit engine are all within reach for Dynavax. The financial blueprint behind this narrative leans on aggressive assumptions about sales acceleration and future profitability. Want to see what could power a price breakout? Get ready to unpack the surprising projections sitting at the heart of this fair value estimate.

Result: Fair Value of $22.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing dependence on a single product and persistent vaccine hesitancy mean that any disruption or demand slowdown could quickly derail the bullish outlook.

Find out about the key risks to this Dynavax Technologies narrative.Another View: DCF Model Checks the Numbers

To weigh things up from a different angle, our SWS DCF model also suggests the company is trading at an attractive price. But does this cash flow-focused perspective confirm the opportunity, or does it overlook key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dynavax Technologies Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own take on Dynavax in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dynavax Technologies.

Looking for More Smart Opportunities?

Take action now to upgrade your investing strategy. With so much buzz around Dynavax, now’s the perfect moment to size up other compelling ideas using the powerful Simply Wall St Screener tools. These could be the opportunities you wish you hadn’t missed.

- Tap into fresh income streams by spotting markets filled with dividend stocks with yields > 3%. This approach is ideal for those seeking stable returns from solid companies with impressive yield potential.

- Ride the momentum of groundbreaking tech by seizing exposure to AI penny stocks at the intersection of innovation and high growth.

- Capitalize on untapped potential and strong fundamentals with access to undervalued stocks based on cash flows where value-driven investors uncover tomorrow’s winners before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DVAX

Dynavax Technologies

A commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives