- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Investor Optimism Abounds Denali Therapeutics Inc. (NASDAQ:DNLI) But Growth Is Lacking

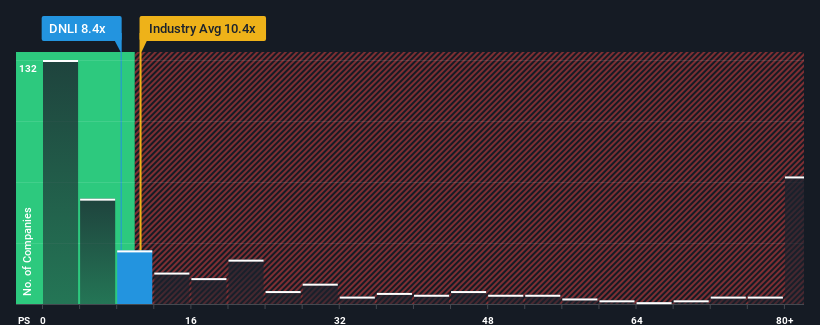

With a median price-to-sales (or "P/S") ratio of close to 10.4x in the Biotechs industry in the United States, you could be forgiven for feeling indifferent about Denali Therapeutics Inc.'s (NASDAQ:DNLI) P/S ratio of 8.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Denali Therapeutics

What Does Denali Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Denali Therapeutics has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Denali Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Denali Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Denali Therapeutics would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 205% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 6.1% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 107% each year.

With this in consideration, we think it doesn't make sense that Denali Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Denali Therapeutics' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Denali Therapeutics currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You need to take note of risks, for example - Denali Therapeutics has 4 warning signs (and 1 which is concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives