- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Improved Revenues Required Before Denali Therapeutics Inc. (NASDAQ:DNLI) Shares Find Their Feet

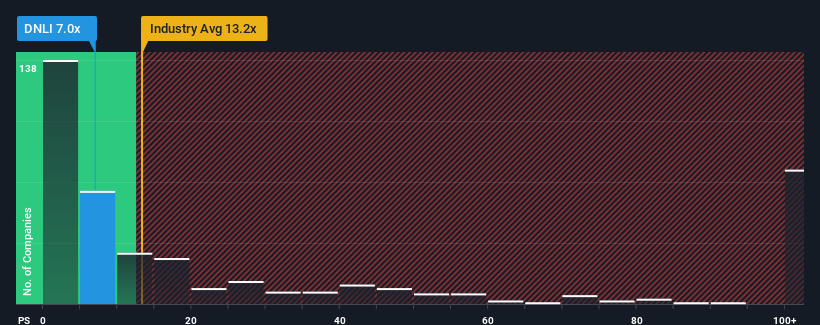

Denali Therapeutics Inc.'s (NASDAQ:DNLI) price-to-sales (or "P/S") ratio of 7x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 13.2x and even P/S above 54x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Denali Therapeutics

What Does Denali Therapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Denali Therapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Denali Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Denali Therapeutics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 208%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 14% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 238% per annum, which paints a poor picture.

With this information, we are not surprised that Denali Therapeutics is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Denali Therapeutics' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Denali Therapeutics (1 is potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Denali Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives