- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

How Does Denali Therapeutics' (DNLI) Regulatory Strategy Reflect Its Rare Disease Ambitions?

Reviewed by Sasha Jovanovic

- Denali Therapeutics recently announced that the FDA has extended its review timeline for the Biologics License Application of tividenofusp alfa, shifting the PDUFA decision date for Hunter syndrome treatment from January to April 2026 after a submission of updated clinical pharmacology data.

- This extension was not due to efficacy or safety concerns, highlighting the complexity of the regulatory process rather than issues with tividenofusp alfa's clinical profile.

- We’ll explore how the FDA’s review extension and ongoing regulatory engagement shape Denali’s investment narrative in rare disease therapeutics.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Denali Therapeutics' Investment Narrative?

For Denali Therapeutics, the thesis revolves around breakthrough innovation in rare disease treatments, especially with its lead candidate tividenofusp alfa targeting Hunter syndrome. Investors are typically attracted by Denali’s focus on central nervous system delivery, platforms with potential in multiple indications, and visible regulatory progress. The recent FDA review extension by three months, prompted by Denali’s updated clinical pharmacology data, alters the timing of a key short-term catalyst but doesn’t drastically affect the underlying investment narrative or overall risk profile. Importantly, the FDA’s rationale wasn’t tied to new concerns about efficacy or safety, so many investors are likely to view this as a process delay rather than a negative development. However, the extension does mean an even longer period without commercial revenues, so maintaining funding and investor confidence remains critical while Denali continues to deepen its pipeline and regulatory engagement.

But while the process delay seems immaterial for efficacy risk, investors should not overlook the growing cash burn.

Exploring Other Perspectives

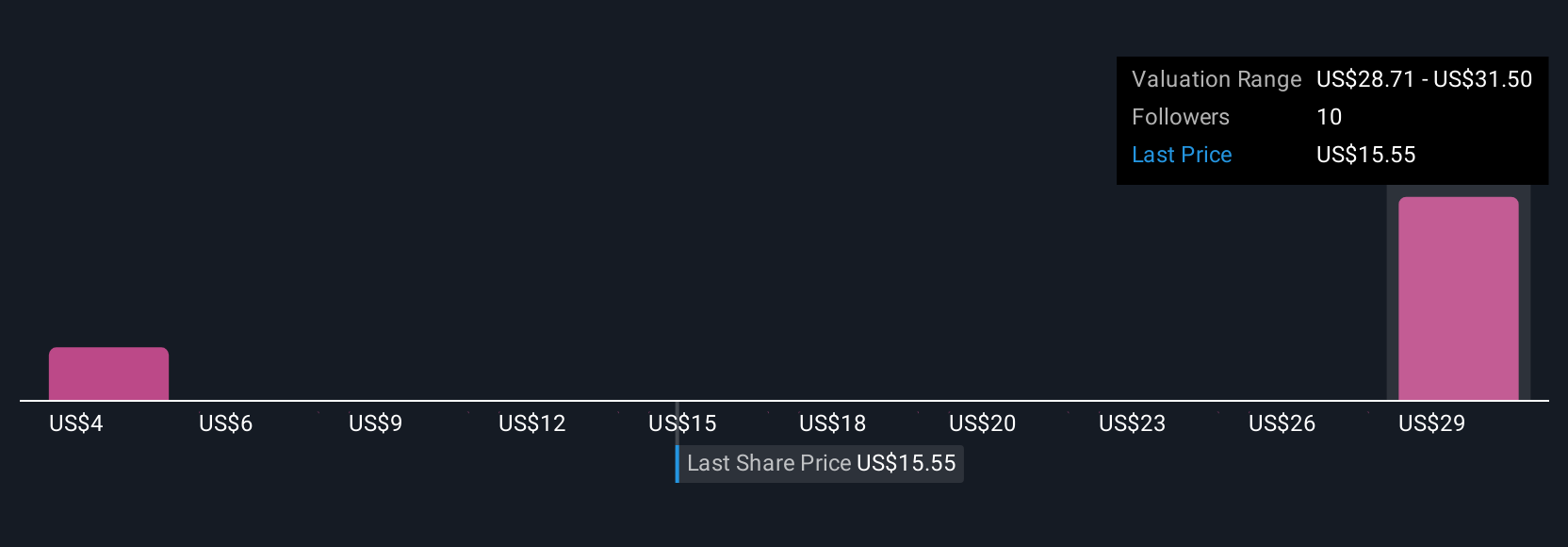

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives