- United States

- /

- Biotech

- /

- OTCPK:DMTK.Q

DermTech, Inc. (NASDAQ:DMTK) Not Doing Enough For Some Investors As Its Shares Slump 44%

To the annoyance of some shareholders, DermTech, Inc. (NASDAQ:DMTK) shares are down a considerable 44% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

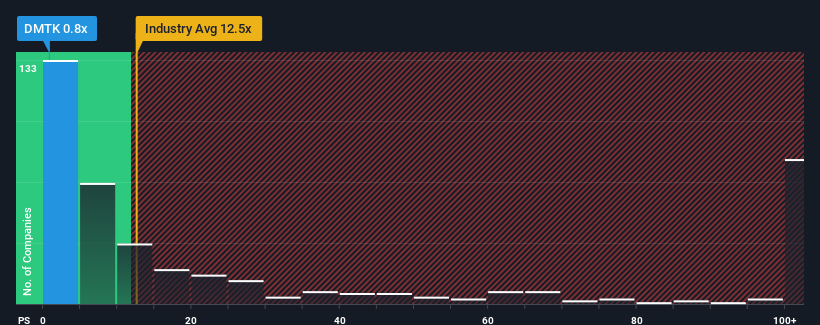

After such a large drop in price, DermTech's price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.5x and even P/S above 66x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for DermTech

How DermTech Has Been Performing

With revenue growth that's inferior to most other companies of late, DermTech has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on DermTech will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For DermTech?

In order to justify its P/S ratio, DermTech would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. Pleasingly, revenue has also lifted 129% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 329%, which is noticeably more attractive.

In light of this, it's understandable that DermTech's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On DermTech's P/S

Shares in DermTech have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of DermTech's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 5 warning signs for DermTech (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on DermTech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:DMTK.Q

DermTech

A molecular diagnostic company, engages in the development and marketing of novel non-invasive genomics tests to aid in the diagnosis and management of melanoma in the United States.

Mediocre balance sheet low.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026