- United States

- /

- Biotech

- /

- NasdaqGS:DCPH

Deciphera Pharmaceuticals, Inc.'s (NASDAQ:DCPH) 61% Share Price Surge Not Quite Adding Up

Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH) shares have continued their recent momentum with a 61% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 75%.

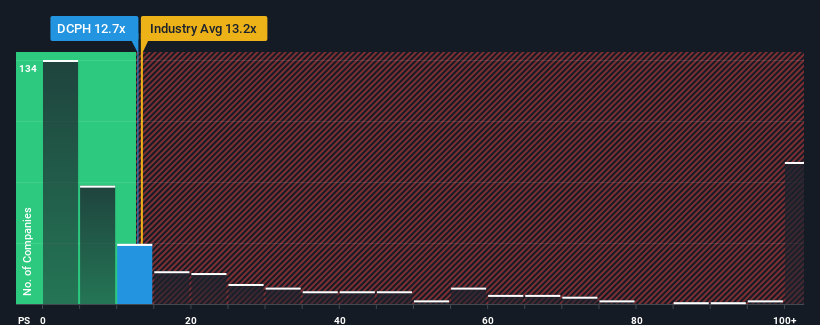

Although its price has surged higher, it's still not a stretch to say that Deciphera Pharmaceuticals' price-to-sales (or "P/S") ratio of 12.7x right now seems quite "middle-of-the-road" compared to the Biotechs industry in the United States, where the median P/S ratio is around 13.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Deciphera Pharmaceuticals

What Does Deciphera Pharmaceuticals' Recent Performance Look Like?

Recent times haven't been great for Deciphera Pharmaceuticals as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Deciphera Pharmaceuticals will help you uncover what's on the horizon.How Is Deciphera Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Deciphera Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. Pleasingly, revenue has also lifted 288% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 32% each year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 163% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's curious that Deciphera Pharmaceuticals' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Deciphera Pharmaceuticals' P/S?

Deciphera Pharmaceuticals appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Deciphera Pharmaceuticals' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Deciphera Pharmaceuticals (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Deciphera Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DCPH

Deciphera Pharmaceuticals

A biopharmaceutical company, develops drugs to enhance the lives of cancer patients by addressing key mechanisms of drug resistance that limit the rate and durability of response to existing cancer therapies in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives