- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Does Litigation Over FDA Risk Disclosures Alter the Bull Case for Cytokinetics (CYTK)?

Reviewed by Sasha Jovanovic

- Multiple law firms recently announced that class action lawsuits have been filed against Cytokinetics, Incorporated, alleging violations of federal securities laws related to disclosures about the FDA approval process for its drug aficamten.

- This legal development centers on claims that the company failed to disclose critical regulatory risks, such as the absence of a Risk Evaluation and Mitigation Strategy, which may have implications for the drug’s timeline and commercialization prospects.

- We'll examine how these regulatory risk disclosures and pending litigation could affect Cytokinetics’ investment narrative and future outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cytokinetics Investment Narrative Recap

At its core, the Cytokinetics investment story revolves around belief in aficamten’s successful regulatory approval and commercial launch in hypertrophic cardiomyopathy. The recent class action lawsuits highlight regulatory disclosure concerns and serve as a reminder of the near-term risks to the all-important FDA approval, which remains the primary catalyst and single biggest risk; while the impact of the lawsuits is material for investor sentiment, the most significant immediate threat to the business is still any delay or complication with the FDA process for aficamten.

In this context, Cytokinetics’ announcement of its upcoming third quarter earnings call on November 5, 2025, stands out. Management is expected to provide updates on commercial readiness and address questions about regulatory progress, which aligns directly with the major catalyst and the issues raised by recent litigation.

By contrast, not every investor is focused on the potential time lag introduced by unresolved REMS requirements, a detail that could…

Read the full narrative on Cytokinetics (it's free!)

Cytokinetics' outlook anticipates $649.5 million in revenue and $90.6 million in earnings by 2028. This scenario requires 96.4% annual revenue growth and a $696.9 million increase in earnings from current earnings of -$606.3 million.

Uncover how Cytokinetics' forecasts yield a $75.83 fair value, a 32% upside to its current price.

Exploring Other Perspectives

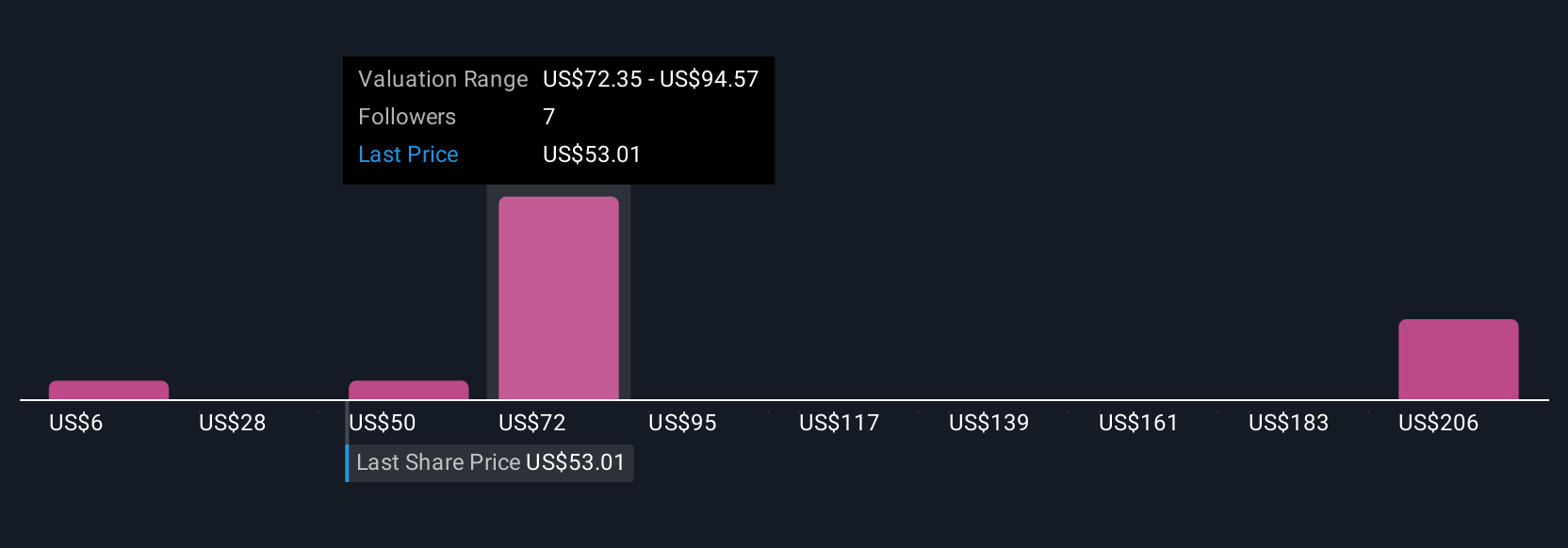

Five fair value estimates from the Simply Wall St Community span from as low as US$5.69 to as high as US$207.16 per share. With such range, keep in mind that reliance on pending regulatory approval drives much of Cytokinetics’ near-term potential and risk, so it’s worth weighing different opinions closely.

Explore 5 other fair value estimates on Cytokinetics - why the stock might be worth over 3x more than the current price!

Build Your Own Cytokinetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cytokinetics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Cytokinetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cytokinetics' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives