- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics (CYTK) Is Up 13.0% After Positive Aficamten Data and Regulatory Scrutiny - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Cytokinetics recently presented new clinical data at the 2025 Heart Failure Society of America Annual Scientific Meeting, showing that its investigational therapy aficamten improved exercise performance and symptom burden in patients with both obstructive and non-obstructive hypertrophic cardiomyopathy.

- These clinical advancements come amid a wave of investor lawsuits alleging the company made misleading statements about regulatory submission requirements for aficamten, intensifying attention toward both its drug development progress and transparency practices.

- We'll now explore how aficamten's positive clinical results and ongoing regulatory scrutiny could reshape Cytokinetics' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cytokinetics Investment Narrative Recap

To be a shareholder in Cytokinetics, you need to believe in the company's ability to deliver regulatory approval and commercial success for aficamten, its late-stage therapy for hypertrophic cardiomyopathy. The recent clinical results at the HFSA meeting are a positive indicator for this catalyst in the short term, but ongoing regulatory scrutiny and class action lawsuits represent an ongoing risk; unless there are further delays, the news does not materially shift the near-term outlook for approval.

Among recent announcements, the FDA’s extension of aficamten’s PDUFA date to December 26, 2025, for additional review of the Risk Evaluation and Mitigation Strategy is especially relevant. This delay highlights the importance of regulatory milestones, since any further holdups could impact both investor expectations and the timing of future commercial revenues.

However, investors should also be aware that despite recent clinical momentum, ongoing legal scrutiny surrounding regulatory disclosures may still...

Read the full narrative on Cytokinetics (it's free!)

Cytokinetics' outlook anticipates $649.5 million in revenue and $90.6 million in earnings by 2028. Achieving this would require 96.4% annual revenue growth and an earnings increase of $696.9 million from current earnings of -$606.3 million.

Uncover how Cytokinetics' forecasts yield a $74.41 fair value, a 31% upside to its current price.

Exploring Other Perspectives

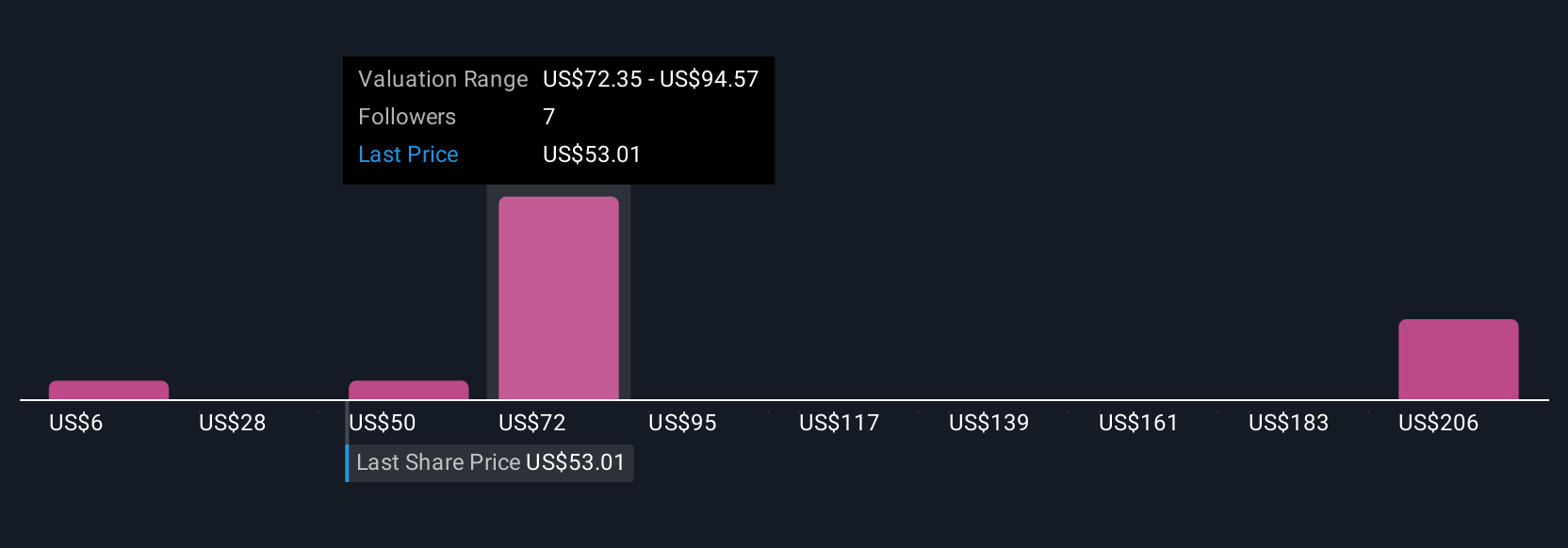

Five fair value estimates from the Simply Wall St Community span US$5.69 to US$211.54, reflecting a wide range of investor views. Regulatory delays and approval risks remain a key focal point that could influence how these differing perspectives play out.

Explore 5 other fair value estimates on Cytokinetics - why the stock might be worth over 3x more than the current price!

Build Your Own Cytokinetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cytokinetics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Cytokinetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cytokinetics' overall financial health at a glance.

No Opportunity In Cytokinetics?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives