- United States

- /

- Life Sciences

- /

- NasdaqCM:CYRX

Investors Continue Waiting On Sidelines For Cryoport, Inc. (NASDAQ:CYRX)

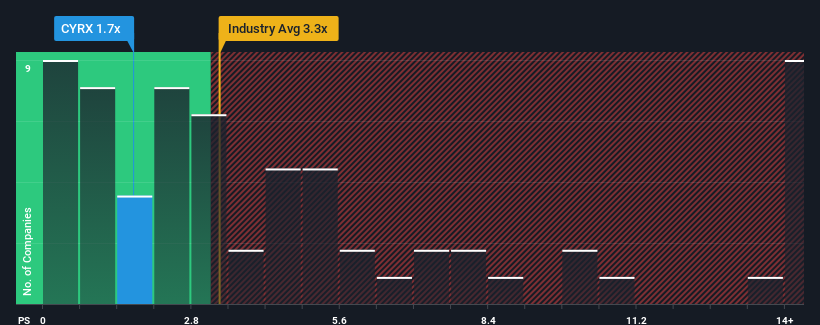

You may think that with a price-to-sales (or "P/S") ratio of 1.7x Cryoport, Inc. (NASDAQ:CYRX) is a stock worth checking out, seeing as almost half of all the Life Sciences companies in the United States have P/S ratios greater than 3.3x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Cryoport

What Does Cryoport's P/S Mean For Shareholders?

Cryoport hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Cryoport's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Cryoport's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.4% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 6.6% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.2%, which is not materially different.

With this in consideration, we find it intriguing that Cryoport's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Cryoport's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Cryoport remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cryoport you should be aware of.

If you're unsure about the strength of Cryoport's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CYRX

Cryoport

Provides temperature-controlled supply chain solutions in biopharma/pharma, animal health, and reproductive medicine markets worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives