- United States

- /

- Life Sciences

- /

- NasdaqCM:CYRX

Cryoport, Inc.'s (NASDAQ:CYRX) Subdued P/S Might Signal An Opportunity

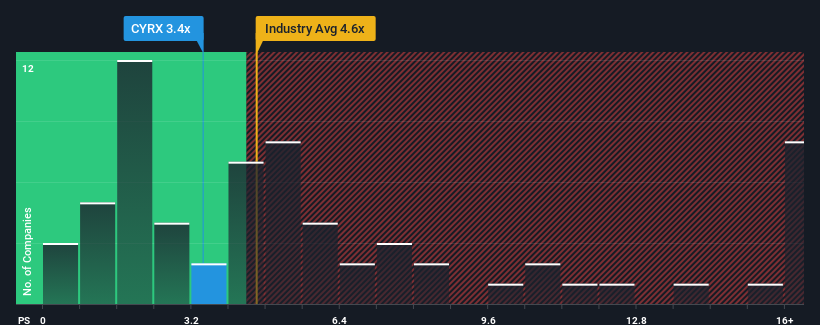

Cryoport, Inc.'s (NASDAQ:CYRX) price-to-sales (or "P/S") ratio of 3.4x might make it look like a buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 4.6x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cryoport

How Has Cryoport Performed Recently?

With revenue growth that's superior to most other companies of late, Cryoport has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Cryoport will help you uncover what's on the horizon.How Is Cryoport's Revenue Growth Trending?

In order to justify its P/S ratio, Cryoport would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 15% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.3%, which is noticeably less attractive.

With this information, we find it odd that Cryoport is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Cryoport's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Cryoport's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cryoport you should know about.

If these risks are making you reconsider your opinion on Cryoport, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Cryoport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CYRX

Cryoport

Provides temperature-controlled supply chain solutions in biopharma/pharma, animal health, and reproductive medicine markets in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet and fair value.