- United States

- /

- Biotech

- /

- NasdaqGM:CVAC

Can New Board Leadership at CureVac (CVAC) Shift the Narrative After Recent Earnings Decline?

Reviewed by Sasha Jovanovic

- CureVac N.V. recently held an Extraordinary General Meeting where shareholders approved the conditional appointment of Ramón Zapata Gomez as managing director, alongside Sierk Poetting, James Ryan, and Annemarie Hanekamp as supervisory directors.

- Shortly before these board changes, CureVac reported sharply lower sales and net income for the third quarter and nine months ended September 30, 2025, compared to the previous year.

- With earnings showing substantial declines, we will examine how this weaker financial performance may influence CureVac's overall investment case.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CureVac Investment Narrative Recap

To be a shareholder in CureVac, you need to believe in the company’s potential to deliver value from its research and development portfolio in oncology and infectious diseases, while managing the inherent execution and regulatory risks of early-stage biotech. The recent board appointments, though significant for leadership stability, do not materially alter the near-term catalyst of progressing clinical programs or the biggest current risk, uncertainty around major revenue streams from key partnerships. Among recent announcements, the settlement with GSK in August 2025 stands out as especially relevant, as it provided CureVac with an upfront payment and future royalties. This agreement helps underpin the revenue base at a time when financial results have weakened, supporting near-term cash flow amid ongoing R&D investments. In contrast, investors should be aware of potential disruptions if milestone payments from partners such as GSK are delayed or do not materialize...

Read the full narrative on CureVac (it's free!)

CureVac's narrative projects €157.1 million in revenue and €16.6 million in earnings by 2028. This assumes a 33.1% annual decline in revenue and a €164.1 million decrease in earnings from the current €180.7 million.

Uncover how CureVac's forecasts yield a $5.35 fair value, a 3% downside to its current price.

Exploring Other Perspectives

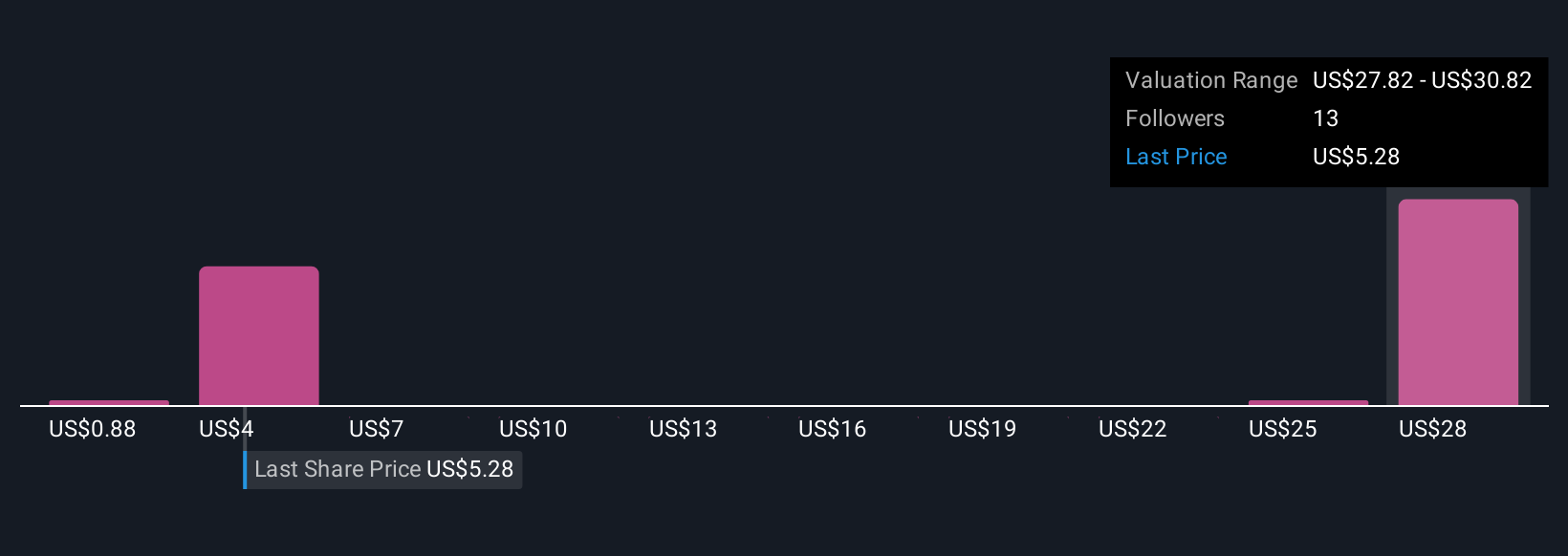

Four separate fair value estimates from the Simply Wall St Community range from €0.88 to €30.19. While opinions differ, many are watching the company's reliance on milestone payments as a crucial signal for performance.

Explore 4 other fair value estimates on CureVac - why the stock might be worth less than half the current price!

Build Your Own CureVac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CureVac research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CureVac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CureVac's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CVAC

CureVac

A biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026