Last Update 29 Jul 25

Fair value Decreased 15%CureVac's analyst price target was revised downward, primarily reflecting a modest improvement in future P/E while profitability remained stable, resulting in a new target of $5.35.

What's in the News

- BioNTech SE has agreed to acquire CureVac N.V. in a stock-for-stock deal, valuing CureVac at approximately $1.25 billion.

- CureVac shareholders will receive around $5.46 in BioNTech ADSs per CureVac share, with the final exchange ratio subject to a collar mechanism based on BioNTech’s share price.

- Upon completion, CureVac will become a wholly owned subsidiary of BioNTech, with its research and manufacturing site in Tübingen integrated into BioNTech’s operations, and CureVac shareholders expected to own 4–6% of BioNTech.

- Major CureVac shareholders representing 50.08% of shares, including dievini Hopp BioTech, KfW, and board members, have committed to tender their shares and vote in favor of the transaction.

- The transaction has unanimous board approval from both companies and is subject to a minimum 80% acceptance threshold by CureVac shareholders and regulatory approvals.

Valuation Changes

Summary of Valuation Changes for CureVac

- The Consensus Analyst Price Target has significantly fallen from $6.31 to $5.35.

- The Future P/E for CureVac has fallen slightly from 91.17x to 88.34x.

- The Net Profit Margin for CureVac remained effectively unchanged, at 10.54%.

Key Takeaways

- Strategic focus on innovation and R&D in oncology and infectious diseases positions CureVac for potential high-growth opportunities and revenue enhancement.

- Strong intellectual property, promising GSK licensing agreements, and a solid cash position bolster competitive edge and future revenue prospects.

- Patent litigation and strategic restructuring pose risks to CureVac's financial stability, operational capabilities, and long-term revenue prospects amidst heavy reliance on partnership milestones.

Catalysts

About CureVac- A biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA).

- CureVac's strategic refocus on technology, innovation, and R&D, alongside a streamlined and rightsized company structure, positions them to capitalize on high-growth opportunities in oncology and infectious diseases, potentially boosting future revenues and earnings.

- The promising progress and upcoming milestone payments in their GSK licensing agreements, including a significant Phase III milestone for a seasonal influenza vaccine, are expected to enhance CureVac's future revenue streams.

- CureVac's expansion into oncology with precision immunotherapy for glioblastoma and squamous non-small cell lung cancer, bolstered by promising early-phase trial data, could lead to significant revenue growth once these programs progress into more advanced stages.

- The robust intellectual property position, as affirmed by recent patent validations, strengthens CureVac's competitive edge and future licensing opportunities, potentially increasing long-term revenue and margins.

- The company's financial health, evidenced by a strong cash position and decreased operating expenses due to a completed workforce reduction, supports sustained investment in R&D while potentially improving net margins and extending financial runway into 2028.

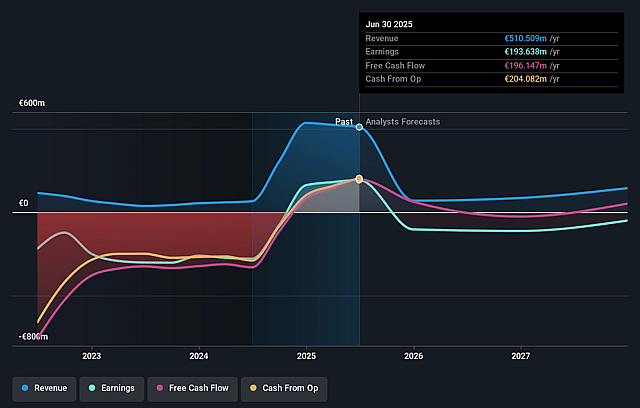

CureVac Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CureVac's revenue will decrease by 33.1% annually over the next 3 years.

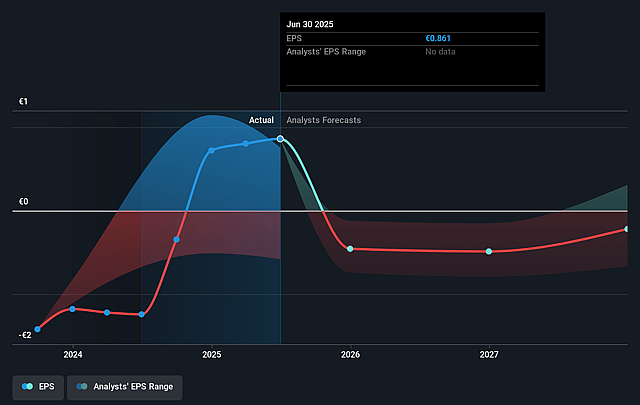

- Analysts are not forecasting that CureVac will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CureVac's profit margin will increase from 34.5% to the average US Biotechs industry of 10.5% in 3 years.

- If CureVac's profit margin were to converge on the industry average, you could expect earnings to reach €16.6 million (and earnings per share of €0.07) by about June 2028, down from €180.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €70.0 million in earnings, and the most bearish expecting €-151.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 91.2x on those 2028 earnings, up from 4.7x today. This future PE is greater than the current PE for the US Biotechs industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

CureVac Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing patent litigation, such as the dispute with Pfizer/BioNTech, presents legal uncertainties that could impact CureVac's financials due to potential legal costs and the risk of damages, which may affect net margins and earnings.

- The strategic restructuring, including a 30% workforce reduction, while aimed at increasing efficiency, could affect operational capabilities in the short term, impacting execution on strategic priorities, which may influence long-term revenue growth.

- Significant dependence on milestone payments from partnerships like the one with GSK for cash flow creates a risk that delays or failures in development and commercialization could negatively impact revenue stability.

- The reliance on successful early-stage trials, particularly in oncology and infectious diseases, presents a risk; if clinical data do not meet expectations, it could hinder pipeline progression, affecting future revenue and earnings potential.

- The phase-out of large-scale manufacturing capabilities may limit the company's ability to rapidly scale up production should demand surge, potentially affecting revenue and market competitiveness.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.307 for CureVac based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.11, and the most bearish reporting a price target of just $2.03.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €157.1 million, earnings will come to €16.6 million, and it would be trading on a PE ratio of 91.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $4.27, the analyst price target of $6.31 is 32.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.