- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Investors Who Bought CRISPR Therapeutics (NASDAQ:CRSP) Shares Three Years Ago Are Now Up 411%

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is CRISPR Therapeutics AG (NASDAQ:CRSP), which saw its share price soar 411% in three years. On top of that, the share price is up 115% in about a quarter.

Check out our latest analysis for CRISPR Therapeutics

CRISPR Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

CRISPR Therapeutics' revenue trended up 81% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 72% per year, over the same period. Despite the strong run, top performers like CRISPR Therapeutics have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

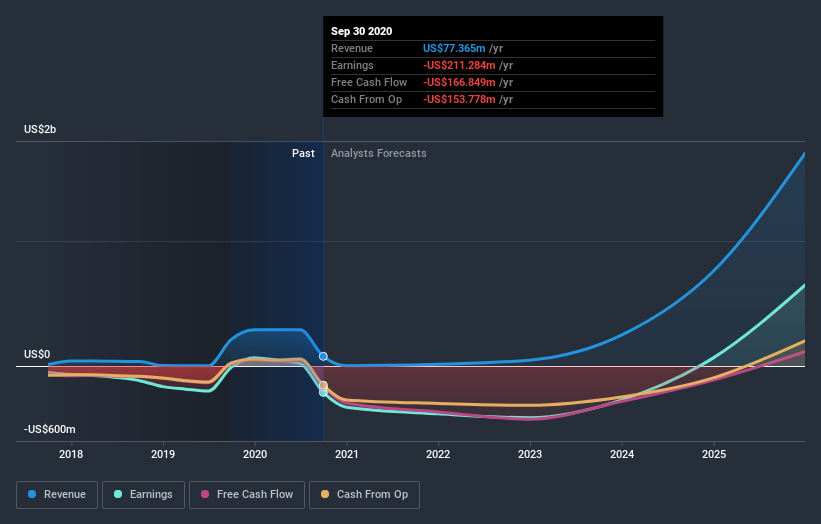

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

CRISPR Therapeutics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think CRISPR Therapeutics will earn in the future (free analyst consensus estimates)

A Different Perspective

Pleasingly, CRISPR Therapeutics' total shareholder return last year was 241%. So this year's TSR was actually better than the three-year TSR (annualized) of 72%. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for CRISPR Therapeutics you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade CRISPR Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade CRISPR Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Market Insights

Community Narratives