- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (NasdaqGM:CRSP) Stock Up 6% Despite US$165 Million Revenue Drop

Reviewed by Simply Wall St

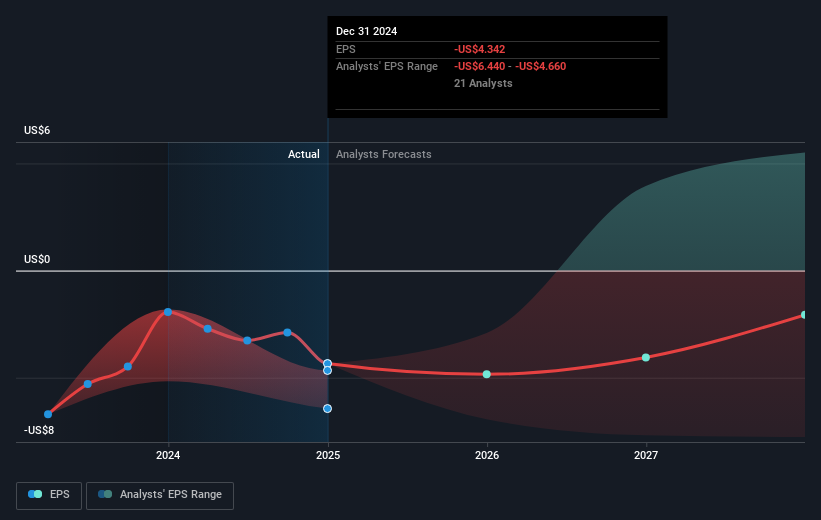

CRISPR Therapeutics (NasdaqGM:CRSP) reported a significant downturn in its financial performance, with revenues and net income showing stark declines compared to the previous year. The earnings announcement revealed a quarterly revenue drop from $201 million to $36 million, alongside increased net losses, reflecting ongoing financial challenges. Despite these troubling figures, CRISPR's stock price moved 6% higher over the past month. This rise occurred in a broader market context where major indices like the S&P 500 and Nasdaq had fluctuating performances amidst mixed investor sentiment driven by recent earnings reports, such as the drop in Nvidia's stock post-earnings and President Trump's tariff announcements. While CRISPR's specific stock price movement could be related to factors internal to the company, external economic news, including the mixed stock market response to macroeconomic conditions, may also have played a part. Overall, this price change underscores a complicated landscape for investors.

Get an in-depth perspective on CRISPR Therapeutics's performance by reading our analysis here.

CRISPR Therapeutics shares have seen a total return of 16.87% decline over the last five years, highlighting significant challenges for the company. During this period, several key events have influenced its performance. Notably, the approval of CASGEVY™ for severe sickle cell disease and transfusion-dependent beta thalassemia in February 2024 was a major milestone. However, this potential positive was offset by ongoing financial challenges, as evidenced by a drop in revenue from $371.21 million to $37.31 million from 2023 to 2024 and increasing net losses over the years.

Relative to the broader market, CRISPR underperformed over the past year as major indices like the US Market returned 16.9%, while CRISPR's returns were less favorable. Adding to their struggles were significant insider selling within the last quarter, and executive turnover with Naimish Patel's appointment as Chief Medical Officer in May 2024. These factors have collectively contributed to the long-term underperformance of CRISPR's stock.

- Understand the fair market value of CRISPR Therapeutics with insights from our valuation analysis—click here to learn more.

- Gain insight into the risks facing CRISPR Therapeutics and how they might influence its performance—click here to read more.

- Hold shares in CRISPR Therapeutics? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives