- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (NASDAQ:CRSP) Shareholders Have Enjoyed A 78% Share Price Gain

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the CRISPR Therapeutics AG (NASDAQ:CRSP) share price is 78% higher than it was a year ago, much better than the market return of around 39% (not including dividends) in the same period. So that should have shareholders smiling. And shareholders have also done well over the long term, with an increase of 71% in the last three years.

See our latest analysis for CRISPR Therapeutics

We don't think CRISPR Therapeutics' revenue of US$1,101,000 is enough to establish significant demand. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that CRISPR Therapeutics comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Of course, if you time it right, high risk investments like this can really pay off, as CRISPR Therapeutics investors might know.

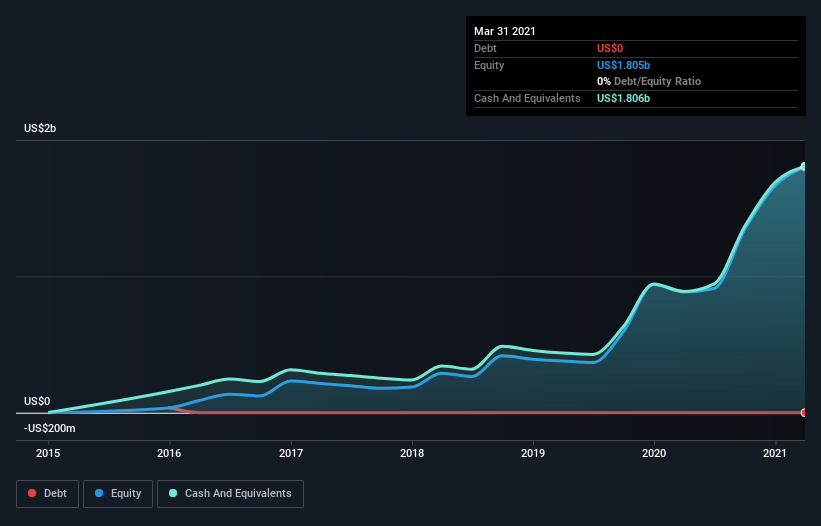

When it last reported its balance sheet in March 2021, CRISPR Therapeutics could boast a strong position, with cash in excess of all liabilities of US$1.7b. That allows management to focus on growing the business, and not worry too much about raising capital. And given that the share price has shot up 109% in the last year , it's fair to say investors are liking management's vision for the future. The image below shows how CRISPR Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

Pleasingly, CRISPR Therapeutics' total shareholder return last year was 78%. That gain actually surpasses the 20% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for CRISPR Therapeutics that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading CRISPR Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives