- United States

- /

- Biotech

- /

- NasdaqGS:CRNX

Investors push Crinetics Pharmaceuticals (NASDAQ:CRNX) 11% lower this week, company's increasing losses might be to blame

The last three months have been tough on Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX) shareholders, who have seen the share price decline a rather worrying 44%. But don't let that distract from the very nice return generated over three years. To wit, the share price did better than an index fund, climbing 64% during that period.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

Check out our latest analysis for Crinetics Pharmaceuticals

We don't think Crinetics Pharmaceuticals' revenue of US$1,039,000 is enough to establish significant demand. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Crinetics Pharmaceuticals comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Crinetics Pharmaceuticals has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

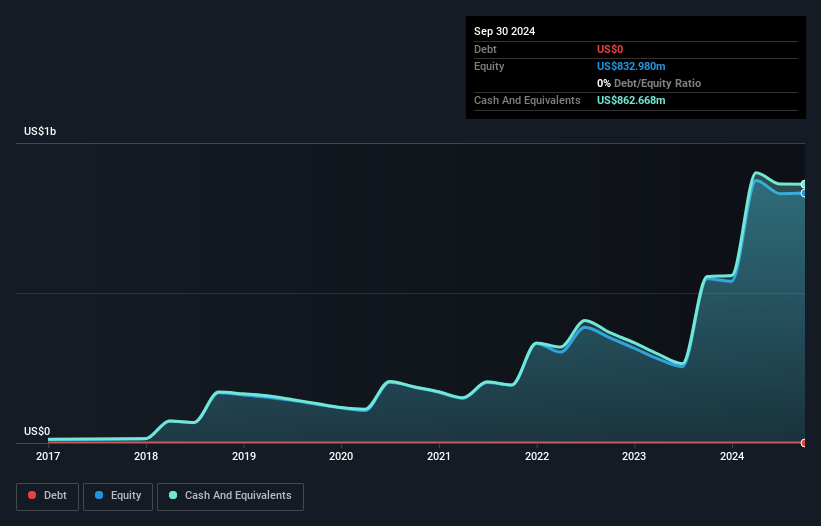

Crinetics Pharmaceuticals had plenty of cash in the bank when it last reported. That allows management to focus on growing the business, and not feel like the recent capital raising was a matter of urgency. And given that the share price has shot up 116% per year, over 3 years , it's fair to say investors are liking management's vision for the future. You can click on the image below to see (in greater detail) how Crinetics Pharmaceuticals' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

Crinetics Pharmaceuticals shareholders are down 24% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Crinetics Pharmaceuticals better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Crinetics Pharmaceuticals you should be aware of, and 1 of them is significant.

But note: Crinetics Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Flawless balance sheet and fair value.

Market Insights

Community Narratives