- United States

- /

- Pharma

- /

- NasdaqGS:CRNX

Assessing Crinetics Pharmaceuticals Valuation After Stock Volatility and Pipeline Progress in 2025

Reviewed by Bailey Pemberton

- If you are wondering whether Crinetics Pharmaceuticals is attractively priced today or if the market has already reflected most of the potential upside, this breakdown walks through what the numbers indicate about its current value.

- After a volatile period, with the stock down 2.2% over the last week and 21.2% over the past year, long-term holders are still sitting on gains of 153.7% over 3 years and 236.4% over 5 years, which reflects both past growth and shifting risk sentiment.

- Recent headlines have focused on Crinetics’ clinical progress and regulatory milestones in its pipeline, supporting the view that investors are emphasizing long-term growth rather than near-term stability. At the same time, analyst coverage has increasingly described the company as a potential leader in its niche, which can contribute to sharp re-ratings when sentiment changes.

- On our valuation checks, Crinetics scores a 3/6. This suggests it appears undervalued on some metrics but not all. Below, we walk through each approach in detail, then conclude with a more holistic, narrative-driven way to think about what the stock might be worth.

Approach 1: Crinetics Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back to today, giving an estimate of what the business is worth in $ right now. For Crinetics Pharmaceuticals, the latest twelve month Free Cash Flow is roughly $350.6 Million in the red, which is typical for a clinical stage biotech investing heavily in development.

Analysts expect cash outflows to remain sizeable in the near term, with projected FCF of about $407.3 Million negative in 2026, then improving toward breakeven and turning positive by 2029, when FCF is forecast to reach around $179.7 Million. Beyond the analyst horizon, Simply Wall St extrapolates that cash flows continue to scale up meaningfully over the following years.

Using this 2 Stage Free Cash Flow to Equity model, the intrinsic value for Crinetics is estimated at about $115.51 per share. Compared with the current market price, this implies the shares trade at roughly a 61.0% discount, suggesting investors are heavily discounting the future pipeline.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crinetics Pharmaceuticals is undervalued by 61.0%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Crinetics Pharmaceuticals Price vs Book

For companies that are not yet profitable, price to book is often a more practical yardstick than earnings based metrics, because it anchors valuation to the net assets investors are funding rather than to still negative profits. In a steady state, faster growth and lower perceived risk justify a higher multiple, while slower growth or higher uncertainty usually mean investors should pay less for each dollar of book value.

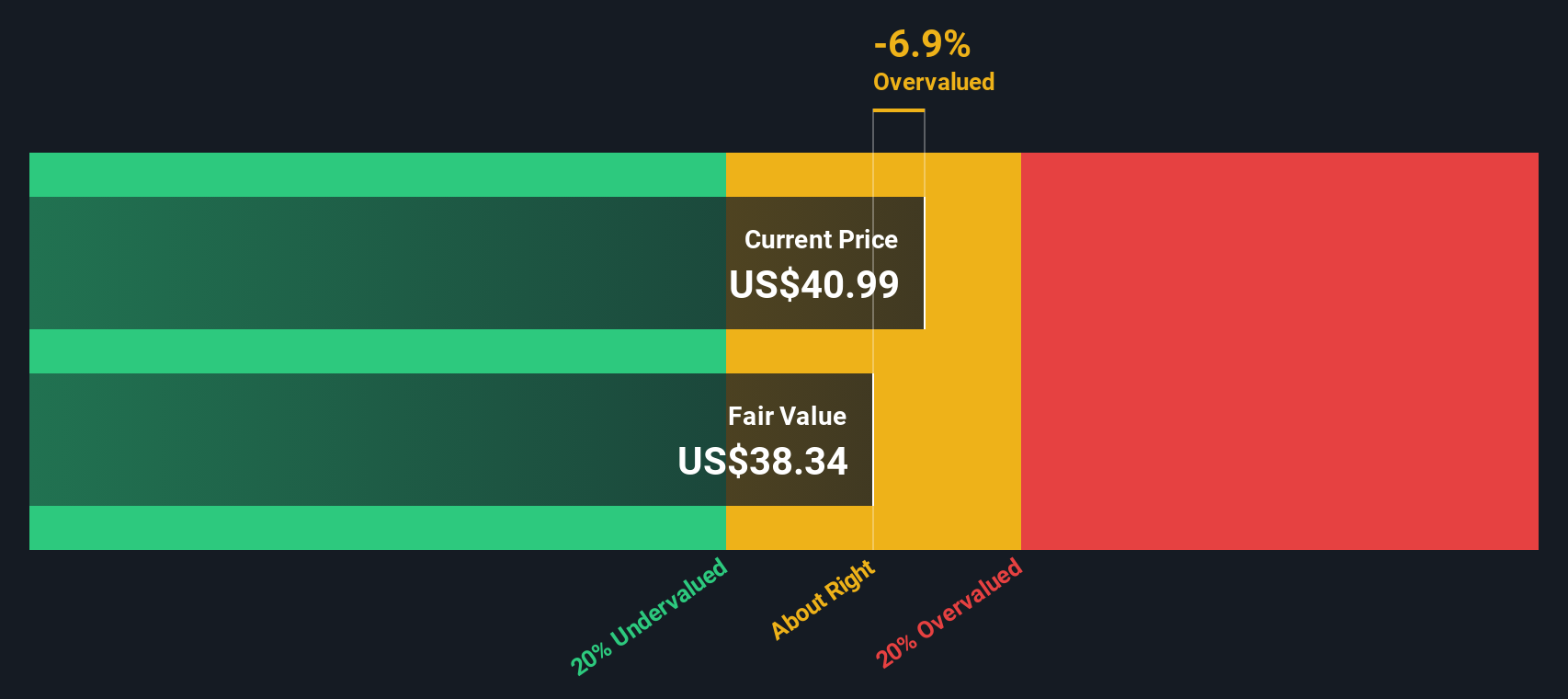

Crinetics currently trades at about 3.98x price to book, compared with the Pharmaceuticals industry average of roughly 2.46x. While that premium suggests the market is already baking in meaningful success from the pipeline, simple peer or industry comparisons can be misleading. Simply Wall St’s Fair Ratio is designed to solve this by estimating what a stock’s preferred multiple should be after adjusting for expected growth, risk profile, profit margins, industry dynamics and market capitalization.

Because the Fair Ratio incorporates these fundamentals directly, it provides a more tailored benchmark than broad peer groups, which may include very different business models and risk levels. On this framework, Crinetics’ current 3.98x looks broadly in line with its fundamentals, pointing to a valuation that is demanding but not excessive.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crinetics Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple story you build around a company, where you spell out what you think its future revenue, earnings and margins could look like, and what that means for fair value. Instead of just staring at ratios, you link Crinetics Pharmaceuticals actual business story, its pipeline, competitive position and regulatory risks, to a clear financial forecast and then to a fair value estimate that you can compare with today’s share price. Narratives are an easy tool on Simply Wall St’s Community page, used by millions of investors, that help you decide whether the gap between Fair Value and current Price suggests it might be time to buy, hold or sell, and they update dynamically as new news, trial results or earnings arrive. For example, one investor might see Crinetics as a high conviction winner with rapid revenue growth and a high fair value, while another assumes slower approvals and more modest margins, leading to a much lower fair value and a very different decision.

Do you think there's more to the story for Crinetics Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNX

Crinetics Pharmaceuticals

A clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026