- United States

- /

- Biotech

- /

- NasdaqCM:CRIS

Curis, Inc. (NASDAQ:CRIS) Surges 27% Yet Its Low P/S Is No Reason For Excitement

Curis, Inc. (NASDAQ:CRIS) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 2.6% isn't as impressive.

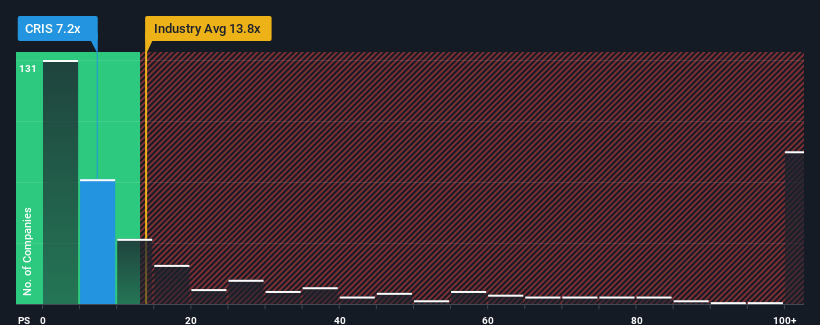

In spite of the firm bounce in price, Curis may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 7.2x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.8x and even P/S higher than 74x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Curis

How Has Curis Performed Recently?

Curis hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Curis will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Curis?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Curis' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 7.5% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.4% per year over the next three years. That's shaping up to be materially lower than the 164% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Curis' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Curis' P/S

Despite Curis' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Curis' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 4 warning signs for Curis that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CRIS

Curis

A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives