- United States

- /

- Biotech

- /

- NasdaqCM:CRIS

Curis, Inc. (NASDAQ:CRIS) Stock Catapults 63% Though Its Price And Business Still Lag The Industry

Curis, Inc. (NASDAQ:CRIS) shareholders have had their patience rewarded with a 63% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

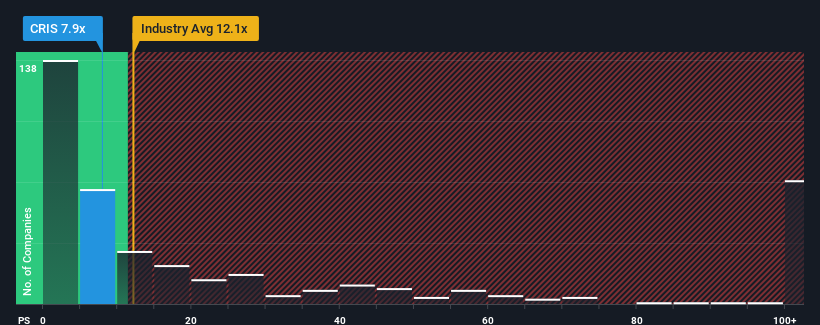

Although its price has surged higher, Curis' price-to-sales (or "P/S") ratio of 7.9x might still make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.1x and even P/S above 50x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Curis

How Has Curis Performed Recently?

While the industry has experienced revenue growth lately, Curis' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Curis' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Curis' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.4% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 240% per year, which is noticeably more attractive.

In light of this, it's understandable that Curis' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Curis' stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Curis' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Curis is showing 5 warning signs in our investment analysis, and 2 of those are significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CRIS

Curis

A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives