- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Is Now The Time To Put Catalyst Pharmaceuticals (NASDAQ:CPRX) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Catalyst Pharmaceuticals (NASDAQ:CPRX). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Our analysis indicates that CPRX is potentially undervalued!

How Fast Is Catalyst Pharmaceuticals Growing Its Earnings Per Share?

Catalyst Pharmaceuticals has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, Catalyst Pharmaceuticals' EPS soared from US$0.40 to US$0.65, over the last year. That's a fantastic gain of 62%.

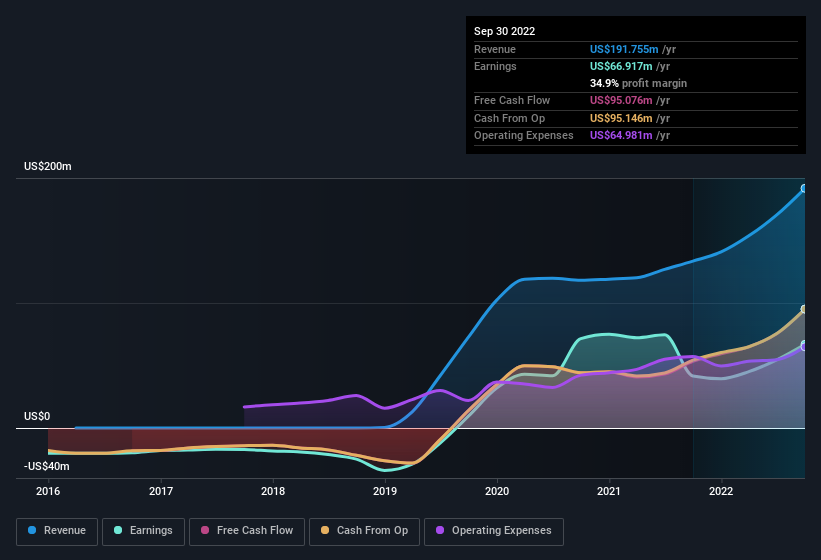

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Catalyst Pharmaceuticals shareholders is that EBIT margins have grown from 36% to 44% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Catalyst Pharmaceuticals' future EPS 100% free.

Are Catalyst Pharmaceuticals Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Catalyst Pharmaceuticals shares worth a considerable sum. With a whopping US$99m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Catalyst Pharmaceuticals with market caps between US$1.0b and US$3.2b is about US$5.5m.

The Catalyst Pharmaceuticals CEO received total compensation of just US$2.1m in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Catalyst Pharmaceuticals Deserve A Spot On Your Watchlist?

You can't deny that Catalyst Pharmaceuticals has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Catalyst Pharmaceuticals has underlying strengths that make it worth a look at. It is worth noting though that we have found 1 warning sign for Catalyst Pharmaceuticals that you need to take into consideration.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies for people with rare debilitating, chronic neuromuscular, and neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives