- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Earnings Tell The Story For Catalyst Pharmaceuticals, Inc. (NASDAQ:CPRX)

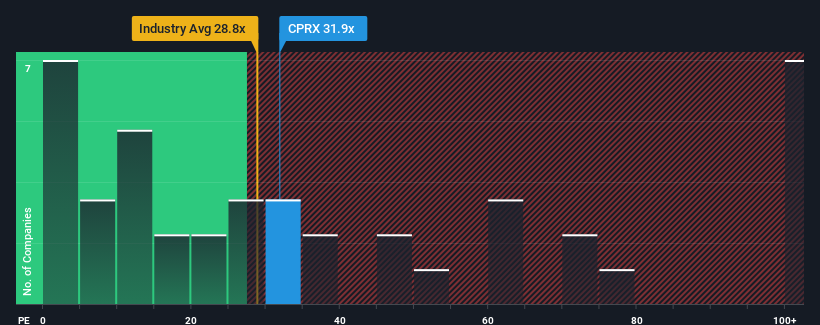

Catalyst Pharmaceuticals, Inc.'s (NASDAQ:CPRX) price-to-earnings (or "P/E") ratio of 31.9x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Catalyst Pharmaceuticals as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Catalyst Pharmaceuticals

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Catalyst Pharmaceuticals' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. As a result, earnings from three years ago have also fallen 21% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 36% per annum during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

In light of this, it's understandable that Catalyst Pharmaceuticals' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Catalyst Pharmaceuticals maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Catalyst Pharmaceuticals, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with outstanding track record.