- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Catalyst Pharmaceuticals (NasdaqCM:CPRX) Navigates Market Volatility With 3% Dip

Reviewed by Simply Wall St

Catalyst Pharmaceuticals (NasdaqCM:CPRX) saw a minor decline of 3% over the past month amidst a backdrop of broader market volatility triggered by new tariffs and economic uncertainties. Despite the relatively modest price movement for the company compared to the significant 12% market drop, potential concerns related to ongoing tariff discussions in the pharmaceutical sector may have added weight. As broader economic concerns and tariff-related market downturns continue to influence investor sentiment, Catalyst's recent performance appears to mirror the market trend, highlighting the effects of external economic pressures over specific company events in this recent period.

Be aware that Catalyst Pharmaceuticals is showing 1 warning sign in our investment analysis.

The recent 3% decline in Catalyst Pharmaceuticals' share price amid broader market volatility and new tariff concerns has posed questions about the company's potential to maintain its growth narrative, particularly in terms of international expansion and patent protection. Over the past five years, the company's shares have delivered a substantial total return of nearly 387%, highlighting its long-term potential in spite of recent short-term pressures. Over the past year, Catalyst's performance has outpaced the US Biotechs industry and broader US market, which both experienced declines. This indicates resilience amid sector challenges and external economic conditions.

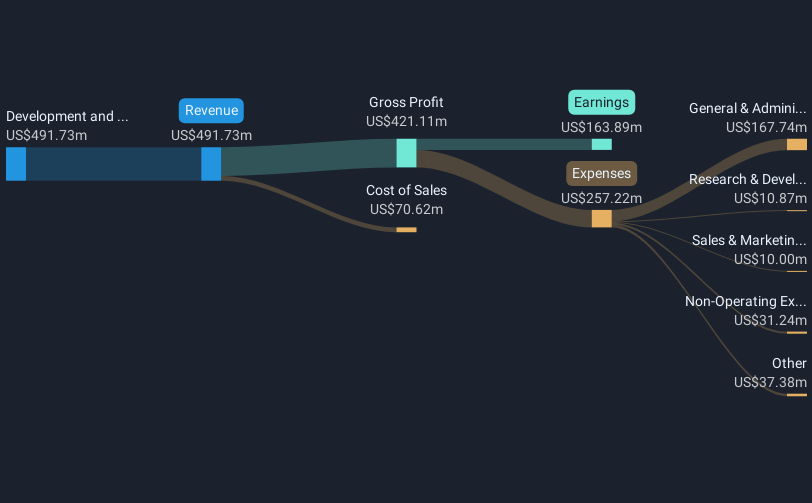

While revenue and earnings forecasts remain optimistic, including expected revenue growth of 11.8% annually over the next three years, the impact of ongoing economic uncertainties and new tariffs might temper these expectations, especially if further market downturns materialize. The current share price of approximately US$23.92 remains significantly below the consensus price target of US$33.88, suggesting potential for appreciation. Investors will need to assess whether Catalyst's growth catalysts, such as continued success with FIRDAPSE and AGAMREE, can withstand broader economic headwinds to realize projected earnings growth of US$252.3 million by April 2028.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with outstanding track record.

Market Insights

Community Narratives