- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has shown a robust 21% increase over the past year, with earnings expected to grow by 14% annually in the coming years. In this context of overall market growth and stability, identifying high growth tech stocks involves looking for companies with strong innovation potential and solid financial health that can capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Bitdeer Technologies Group | 51.86% | 122.49% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Blueprint Medicines | 22.38% | 55.79% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

Click here to see the full list of 230 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

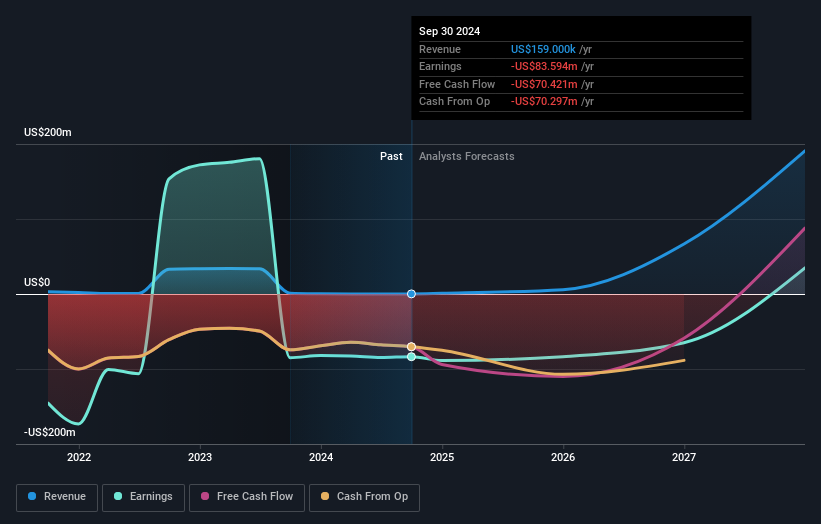

Chimerix (NasdaqGM:CMRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chimerix, Inc. is a biopharmaceutical company focused on developing medicines aimed at improving and extending the lives of patients with life-threatening diseases, with a market capitalization of $456.88 million.

Operations: Chimerix generates revenue primarily from its pharmaceuticals segment, which reported $0.16 million. The company's focus is on developing treatments for life-threatening diseases.

Chimerix's recent FDA nod for accelerated review of dordaviprone, targeting rare H3 K27M-mutant diffuse glioma, underscores its strategic pivot towards specialized therapeutics—a niche but potentially lucrative segment. This development, coupled with a robust 54.1% projected annual revenue growth and an anticipated profit surge of 53.34%, positions the firm distinctively in the high-growth biotech arena. However, its current unprofitability and the highly volatile share price reflect inherent risks. The secured $30 million credit facility enhances financial flexibility but underscores reliance on external financing to fuel operations and R&D initiatives.

- Dive into the specifics of Chimerix here with our thorough health report.

Assess Chimerix's past performance with our detailed historical performance reports.

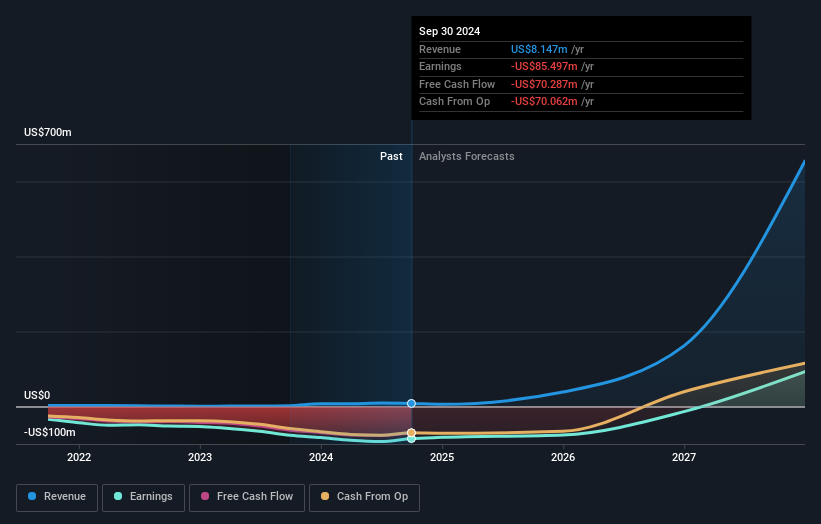

MicroVision (NasdaqGM:MVIS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MicroVision, Inc. focuses on developing and selling lidar sensors and software for automotive safety and autonomous driving applications, with a market cap of $383.28 million.

Operations: The company generates revenue primarily from the sale and servicing of lidar hardware and software, totaling $8.15 million.

MicroVision's aggressive expansion in sensor production, particularly the MOVIA L sensors for industrial use, underscores its strategic alignment with growing demand in tech-intensive sectors. With a projected annual revenue growth of 50.7% and an anticipated shift to profitability within three years, the company is positioning itself advantageously against market norms. However, recent equity offerings and convertible note agreements totaling over $87 million highlight a reliance on external financing to support these ambitious growth plans. Despite this dependency, MicroVision's focus on enhancing production capabilities while controlling costs could pave the way for sustainable growth as it taps into high-demand tech markets.

- Navigate through the intricacies of MicroVision with our comprehensive health report here.

Examine MicroVision's past performance report to understand how it has performed in the past.

Ultragenyx Pharmaceutical (NasdaqGS:RARE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ultragenyx Pharmaceutical Inc. is a biopharmaceutical company dedicated to the identification, acquisition, development, and commercialization of novel products for treating rare and ultra-rare genetic diseases globally, with a market cap of approximately $4.09 billion.

Operations: Ultragenyx Pharmaceutical generates revenue primarily through the identification, acquisition, development, and commercialization of novel products aimed at treating rare and ultra-rare genetic diseases, with reported revenues of $560.23 million.

Ultragenyx Pharmaceutical, amidst a dynamic phase, has recently seen its Biologics License Application for UX111 accepted by the FDA for priority review, potentially accelerating its market entry. This development follows a robust annual revenue growth of 29.6% and an earnings surge projected at 62.74% annually. Notably, the company's commitment to R&D is evident with significant expenditures aimed at pioneering treatments for rare genetic diseases—a strategy that not only addresses unmet medical needs but also positions Ultragenyx distinctively within the biotech landscape. As it navigates through regulatory milestones and advances its diverse pipeline, the firm's innovative approach could set new standards in gene therapy and rare disease treatment sectors.

- Delve into the full analysis health report here for a deeper understanding of Ultragenyx Pharmaceutical.

Understand Ultragenyx Pharmaceutical's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 230 US High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ultragenyx Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

Fair value with limited growth.

Market Insights

Community Narratives