- United States

- /

- Biotech

- /

- NasdaqCM:CMPX

Spotlight On Three Promising Penny Stocks In May 2025

Reviewed by Simply Wall St

As the U.S. market rallies with tech stocks leading gains, investors are increasingly optimistic about the potential for continued growth. Penny stocks, a term that may seem outdated, still represent an intriguing investment area for those interested in smaller or newer companies. By focusing on penny stocks with strong financial health and clear growth potential, investors can uncover opportunities that offer both stability and upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.61 | $372.2M | ✅ 3 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.75 | $3.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.71 | $1.54B | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.14 | $188.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.44 | $56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.66 | $91.2M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.84 | $5.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Dingdong (Cayman) (NYSE:DDL) | $2.37 | $518.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.315 | $81.59M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.935 | $81.31M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Compass Therapeutics (NasdaqCM:CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company that develops antibody-based therapeutics for treating various human diseases, with a market cap of $277.95 million.

Operations: Compass Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $277.95M

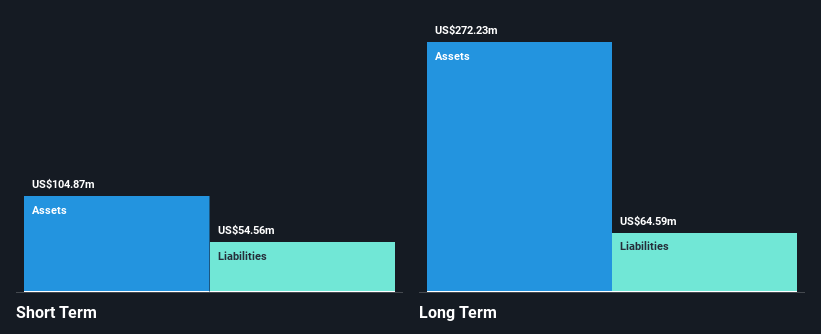

Compass Therapeutics, Inc., with a market cap of US$277.95 million, is a pre-revenue biopharmaceutical company focused on antibody-based therapeutics. Despite its unprofitability and negative return on equity of -50.07%, the company maintains a strong balance sheet with short-term assets exceeding liabilities and no debt. Recent developments include promising clinical trial results for tovecimig in biliary tract cancer (BTC), showing significant improvement in overall response rate when combined with paclitaxel compared to paclitaxel alone. However, high volatility remains a concern, as does the relatively inexperienced management team with an average tenure of 1.8 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Compass Therapeutics.

- Assess Compass Therapeutics' future earnings estimates with our detailed growth reports.

Village Farms International (NasdaqCM:VFF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Village Farms International, Inc. operates in North America producing, marketing, and distributing greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes with a market cap of $78.98 million.

Operations: Village Farms International does not report specific revenue segments.

Market Cap: $78.98M

Village Farms International, with a market cap of US$78.98 million, operates in the greenhouse-grown produce sector and is currently unprofitable with increasing losses over five years. Despite this, the company has reduced its debt-to-equity ratio and maintains a satisfactory net debt level. Recent refinancing efforts have improved financial covenants on its cannabis credit facility, extending maturity to 2028. The company faces delisting risks from Nasdaq due to non-compliance with bid price requirements but has received an extension until October 2025 to rectify this issue. Revenue growth is expected at 13.62% annually, though profitability remains elusive in the near term.

- Dive into the specifics of Village Farms International here with our thorough balance sheet health report.

- Examine Village Farms International's earnings growth report to understand how analysts expect it to perform.

RPC (NYSE:RES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPC, Inc. provides a variety of oilfield services and equipment to oil and gas companies engaged in exploration, production, and development activities, with a market cap of approximately $1.08 billion.

Operations: RPC's revenue is primarily derived from its Technical Services segment, which accounts for $1.28 billion, complemented by its Support Services segment contributing $88.59 million.

Market Cap: $1.08B

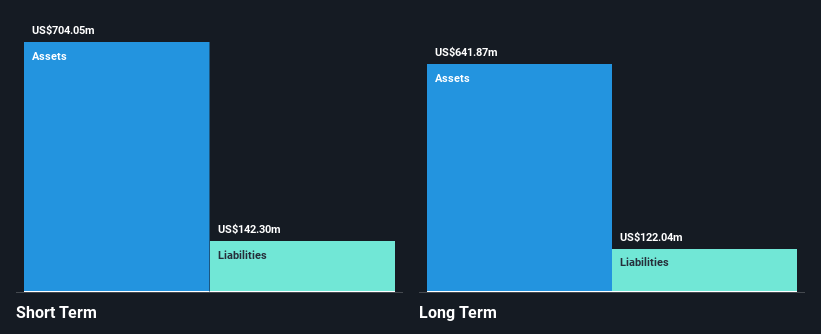

RPC, Inc., with a market cap of US$1.08 billion, operates in the oilfield services sector and has shown profitability growth over the past five years. Despite recent challenges, including a decline in sales to US$332.88 million for Q1 2025 from US$377.83 million a year ago, RPC maintains no debt and strong short-term assets exceeding liabilities. The company is exploring acquisitions to leverage its robust balance sheet and liquidity amidst industry volatility. Although its profit margins have decreased, RPC's price-to-earnings ratio suggests it may be undervalued compared to the broader U.S. market average of 17.9x.

- Take a closer look at RPC's potential here in our financial health report.

- Gain insights into RPC's future direction by reviewing our growth report.

Next Steps

- Click through to start exploring the rest of the 753 US Penny Stocks now.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Terbium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CMPX

Compass Therapeutics

A clinical-stage oncology-focused biopharmaceutical company, engages in the development of antibody-based therapeutics for the treatment of various human diseases in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives