- United States

- /

- Biotech

- /

- NasdaqCM:CMPX

3 Penny Stocks On US Exchanges With Market Caps Under $500M

Reviewed by Simply Wall St

As of February 2025, U.S. stock markets are riding high, with major indexes nearing record levels following a rally led by chipmakers like Nvidia. In this context, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite the term's dated origins. For those looking to explore beyond the giants of Wall Street, penny stocks can offer unique opportunities for growth at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8781 | $6.23M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.12M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.3M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.19M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.06 | $53.61M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $23.94M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.91 | $83.05M | ★★★★★☆ |

| Information Services Group (NasdaqGM:III) | $3.11 | $161.45M | ★★★★☆☆ |

Click here to see the full list of 704 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Compass Therapeutics (NasdaqCM:CMPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company in the U.S. focused on developing antibody-based therapeutics for oncology, with a market cap of $429.28 million.

Operations: Compass Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $429.28M

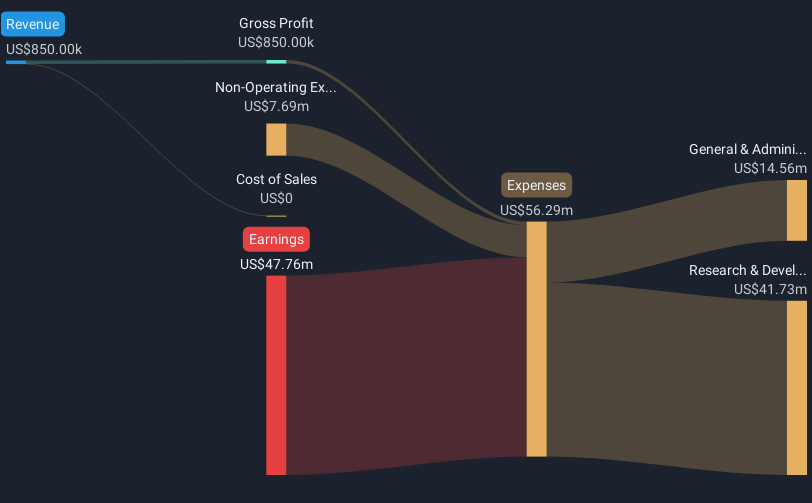

Compass Therapeutics, Inc. is a pre-revenue biopharmaceutical firm with a market cap of US$429.28 million, focused on oncology therapeutics. Despite being unprofitable and not expected to achieve profitability in the near term, the company is debt-free and has sufficient cash runway for over a year. Recent developments include progress on multiple clinical trials such as Phase 2 studies for tovecimig and CTX-471, indicating active advancement in its pipeline. Leadership changes have brought experienced executives like Barry Shin as CFO, potentially strengthening financial oversight as Compass navigates its growth trajectory amidst high share price volatility.

- Dive into the specifics of Compass Therapeutics here with our thorough balance sheet health report.

- Explore Compass Therapeutics' analyst forecasts in our growth report.

Expensify (NasdaqGS:EXFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Expensify, Inc. offers a cloud-based expense management software platform catering to individuals, corporations, small and midsized businesses, and enterprises globally, with a market cap of approximately $340.73 million.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated $137.44 million.

Market Cap: $340.73M

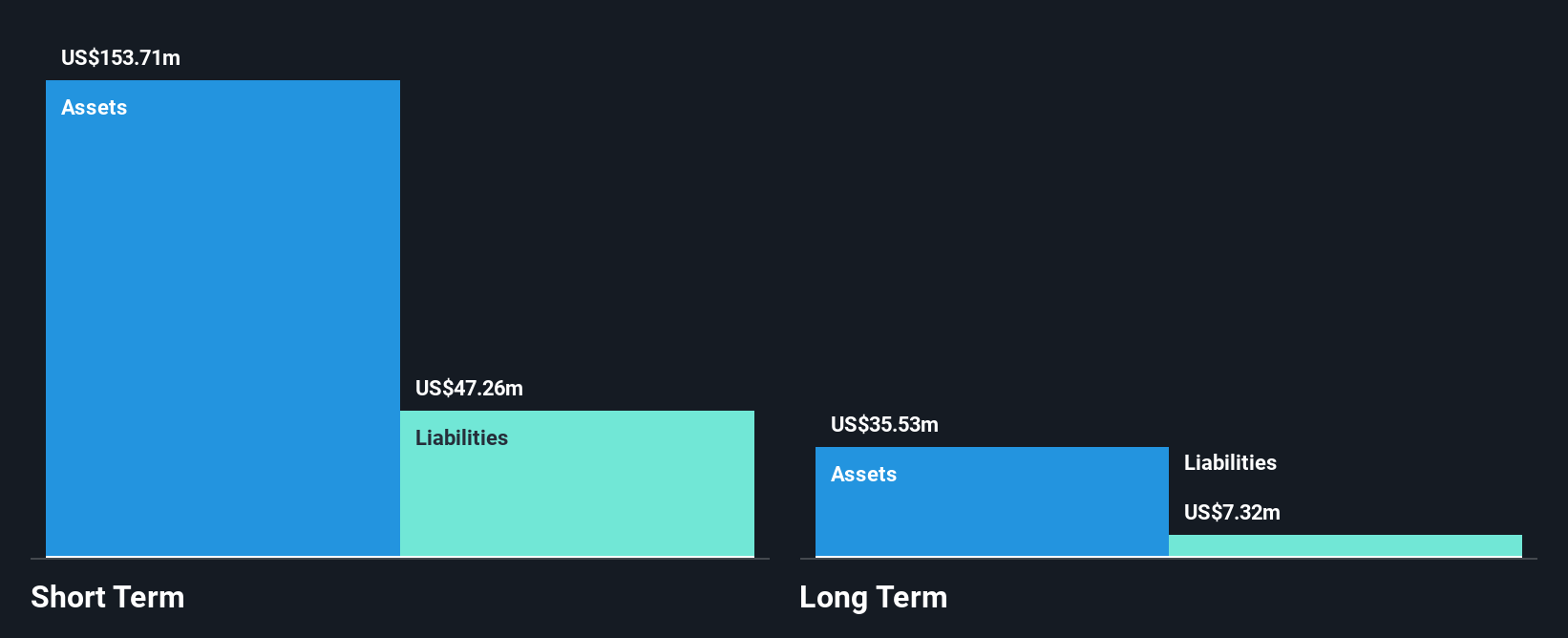

Expensify, Inc., with a market cap of US$340.73 million, remains unprofitable but has a robust cash runway exceeding three years and no debt. Despite experiencing significant insider selling recently, the company has managed to avoid shareholder dilution over the past year. Its short-term assets of US$138.5 million comfortably cover both short and long-term liabilities. Recent earnings reports show a narrowing net loss from US$17 million to US$2.2 million year-over-year for Q3 2024, alongside share buybacks totaling 1,832,887 shares under its ongoing repurchase program announced in May 2022 amidst high share price volatility.

- Navigate through the intricacies of Expensify with our comprehensive balance sheet health report here.

- Gain insights into Expensify's outlook and expected performance with our report on the company's earnings estimates.

Tecogen (OTCPK:TGEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tecogen Inc. designs, manufactures, markets, and maintains ultra-clean cogeneration products for various sectors primarily in the United States, with a market cap of $69.86 million.

Operations: The company generates revenue from three main segments: Products ($4.77 million), Services ($15.95 million), and Energy Production ($2.09 million).

Market Cap: $69.86M

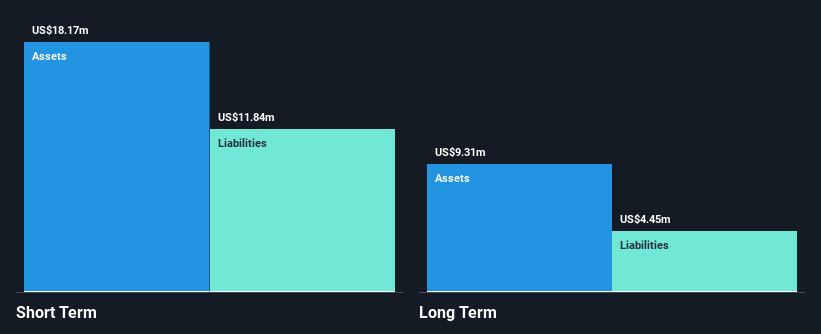

Tecogen Inc., with a market cap of US$69.86 million, faces challenges as it remains unprofitable and has seen a decline in revenue from US$19.24 million to US$16.54 million over nine months ending September 2024. Despite this, the company maintains sufficient short-term assets (US$18.2M) to cover liabilities and has not diluted shareholders recently. Recent orders for cogeneration systems and chillers indicate potential demand, though share price volatility persists alongside increased losses over five years at 0.3% annually. The management team is experienced, with a satisfactory net debt to equity ratio of 2.2%.

- Get an in-depth perspective on Tecogen's performance by reading our balance sheet health report here.

- Gain insights into Tecogen's historical outcomes by reviewing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 701 US Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CMPX

Compass Therapeutics

A clinical-stage oncology-focused biopharmaceutical company, engages in the development of antibody-based therapeutics for the treatment of various human diseases in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives