- United States

- /

- Biotech

- /

- NasdaqGM:CHRS

Investors Aren't Buying Coherus BioSciences, Inc.'s (NASDAQ:CHRS) Revenues

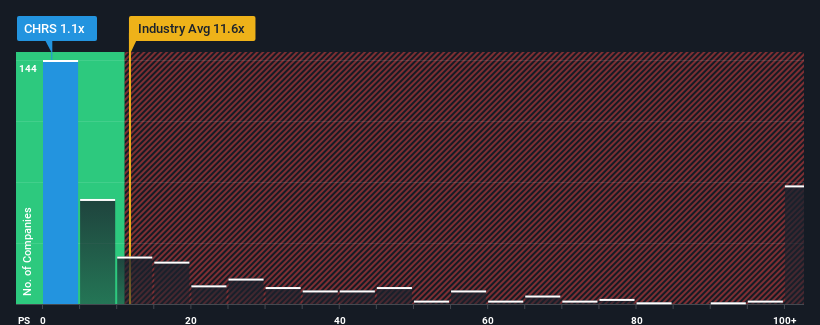

You may think that with a price-to-sales (or "P/S") ratio of 1.1x Coherus BioSciences, Inc. (NASDAQ:CHRS) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 11.6x and even P/S above 49x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Coherus BioSciences

What Does Coherus BioSciences' Recent Performance Look Like?

Coherus BioSciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coherus BioSciences.How Is Coherus BioSciences' Revenue Growth Trending?

In order to justify its P/S ratio, Coherus BioSciences would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 49% per year over the next three years. That's shaping up to be materially lower than the 235% each year growth forecast for the broader industry.

In light of this, it's understandable that Coherus BioSciences' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Coherus BioSciences' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Coherus BioSciences maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Coherus BioSciences (of which 2 don't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CHRS

Coherus BioSciences

A biopharmaceutical company, researches, develops, and commercializes immunotherapies to treat cancer in the United States.

Moderate and fair value.