- United States

- /

- Biotech

- /

- NasdaqGS:CGON

Will Cretostimogene’s Strong 24-Month Results Reshape CG Oncology's (CGON) Immuno-Oncology Narrative?

Reviewed by Simply Wall St

- CG Oncology announced updated long-term results from its Phase 3 BOND-003 trial, showing cretostimogene achieved a 41.8% complete response rate at 24 months in high-risk, heavily pretreated non-muscle invasive bladder cancer patients, with no grade 3 or greater treatment-related adverse events or deaths reported.

- This marks one of the most durable long-term response rates observed in this difficult patient population, with 90% of 12-month responders maintaining response at two years.

- We’ll explore how cretostimogene’s sustained efficacy at 24 months could influence CG Oncology’s investment narrative in the immuno-oncology sector.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is CG Oncology's Investment Narrative?

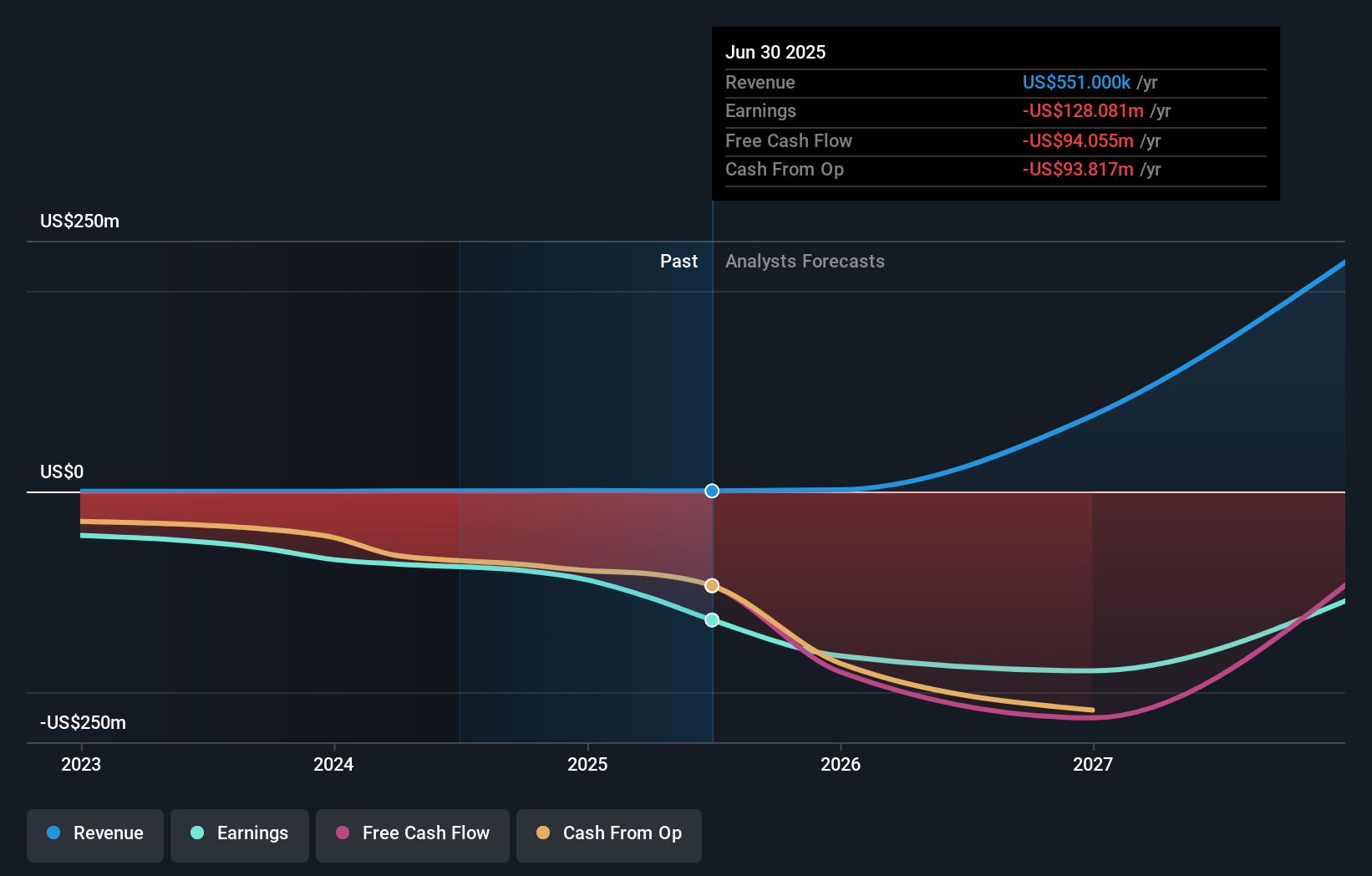

For investors considering CG Oncology, the investment thesis centers on the transformative potential of cretostimogene in a segment of bladder cancer with few effective options. The recent update from the BOND-003 trial, highlighting a 41.8% complete response at 24 months and no grade 3 or higher adverse events, could recalibrate short-term expectations, both as a confidence boost for regulatory outlook and as validation of drug durability claims. This news builds on the already completed PIVOT-006 enrollment, reinforcing cretostimogene’s profile ahead of any pivotal regulatory milestones. Risks remain substantial, especially with rising operating losses and continued need for capital, but the data meaningfully reduces concerns around long-term efficacy and may shift short-term catalysts more toward FDA decision timelines and strategic partnerships. For now, the stock's recent price movement suggests investors see the update as material. On the other hand, dilution and funding risk remain significant areas investors should keep in mind.

CG Oncology's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CG Oncology - why the stock might be a potential multi-bagger!

Build Your Own CG Oncology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CG Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CG Oncology's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGON

CG Oncology

A late-stage clinical biopharmaceutical company, develops and commercializes backbone bladder-sparing therapeutics for patients with bladder cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives