- United States

- /

- Biotech

- /

- NasdaqGS:CGON

CG Oncology (CGON): Valuation in Focus After Analyst Coverage and Promising Cretostimogene Phase 3 Results

Reviewed by Kshitija Bhandaru

CG Oncology (CGON) has come into focus following fresh analyst coverage and new clinical trial data. Recent updates highlight promising results for cretostimogene in high-risk non-muscle invasive bladder cancer, which is drawing investor attention to upcoming milestones.

See our latest analysis for CG Oncology.

After releasing encouraging Phase 3 data and landing fresh positive analyst coverage, CG Oncology’s share price momentum has shifted firmly upward, notching a 50% return over the past 90 days. The 1-year total shareholder return of 17% hints at growing optimism around its clinical pipeline, with investors anticipating key regulatory milestones ahead.

If you’re curious to see how other biotechs are building momentum, check out the full list of healthcare innovators in our curated screener in See the full list for free.

The big question now is whether CG Oncology’s rapid gains still leave the stock undervalued given significant upcoming milestones, or if the market has already factored much of the company’s anticipated growth into the current price.

Price-to-Book of 4.6x: Is it justified?

CG Oncology is currently trading at a price-to-book ratio of 4.6x, notably higher than the US Biotechs industry average of 2.5x. This positions the stock as relatively expensive on this measure compared to many of its sector peers, despite recent price momentum.

The price-to-book ratio reflects what investors are willing to pay for each dollar of net assets. For biotechnology companies like CG Oncology, where near-term profitability may not always be present, this metric highlights how much the market is factoring in future growth potential and the value of research pipelines and intellectual property.

Although CG Oncology’s price-to-book ratio is above the industry average, it is far lower compared to the peer average of 13.3x. This suggests the company may still offer comparatively good value within its closer peer group. The difference may be due to sought-after clinical progress and expanding revenue forecasts.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4.6x (OVERVALUED)

However, setbacks in clinical trials or slower than expected regulatory progress could quickly dampen optimism surrounding CG Oncology’s near-term valuation.

Find out about the key risks to this CG Oncology narrative.

Another View: Our DCF Model Suggests Deep Undervaluation

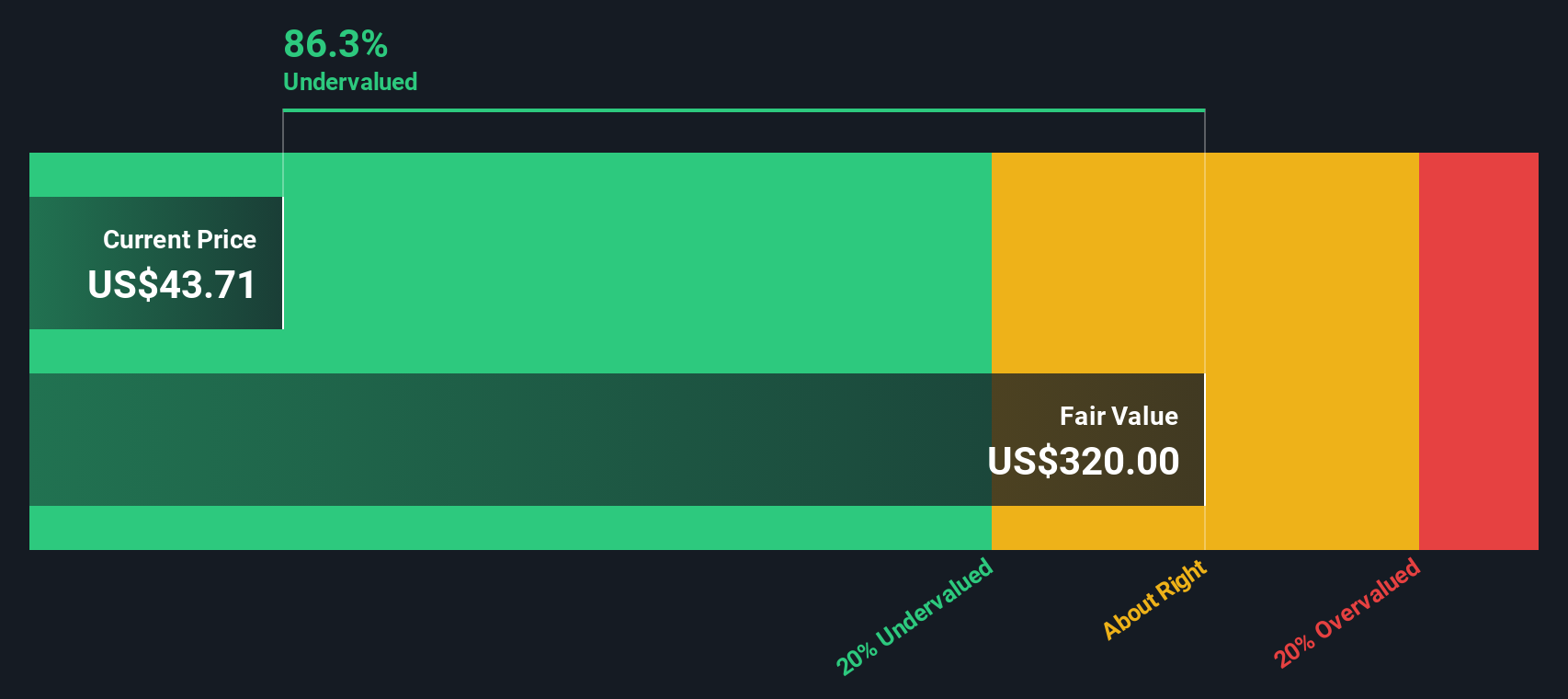

While the price-to-book ratio suggests CG Oncology is expensive compared to the sector, our DCF model takes a longer-term approach. It estimates a fair value of $326.36, meaning the stock trades at an 87.5% discount. Does the market see something the model is missing, or could there be hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CG Oncology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CG Oncology Narrative

If you’d like to dig into the numbers and form your own perspective, you can easily craft a personal narrative in just a few minutes. Do it your way

A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step and expand your opportunities with carefully crafted stock lists. You’ll regret missing these trends when the market moves forward without you.

- Unlock potential returns by getting started with these 892 undervalued stocks based on cash flows and see which stocks are priced attractively based on real cash flow fundamentals.

- Catch up-and-coming disruptors by checking out these 25 AI penny stocks, featuring innovators at the forefront of artificial intelligence breakthroughs.

- Secure income for your portfolio by tapping into these 19 dividend stocks with yields > 3% with yields above 3% to strengthen your investment strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGON

CG Oncology

A late-stage clinical biopharmaceutical company, develops and commercializes backbone bladder-sparing therapeutics for patients with bladder cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives