- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Did Celcuity’s (CELC) $500 Million Milestone-Based Loan Reshape Its Investment Narrative?

Reviewed by Simply Wall St

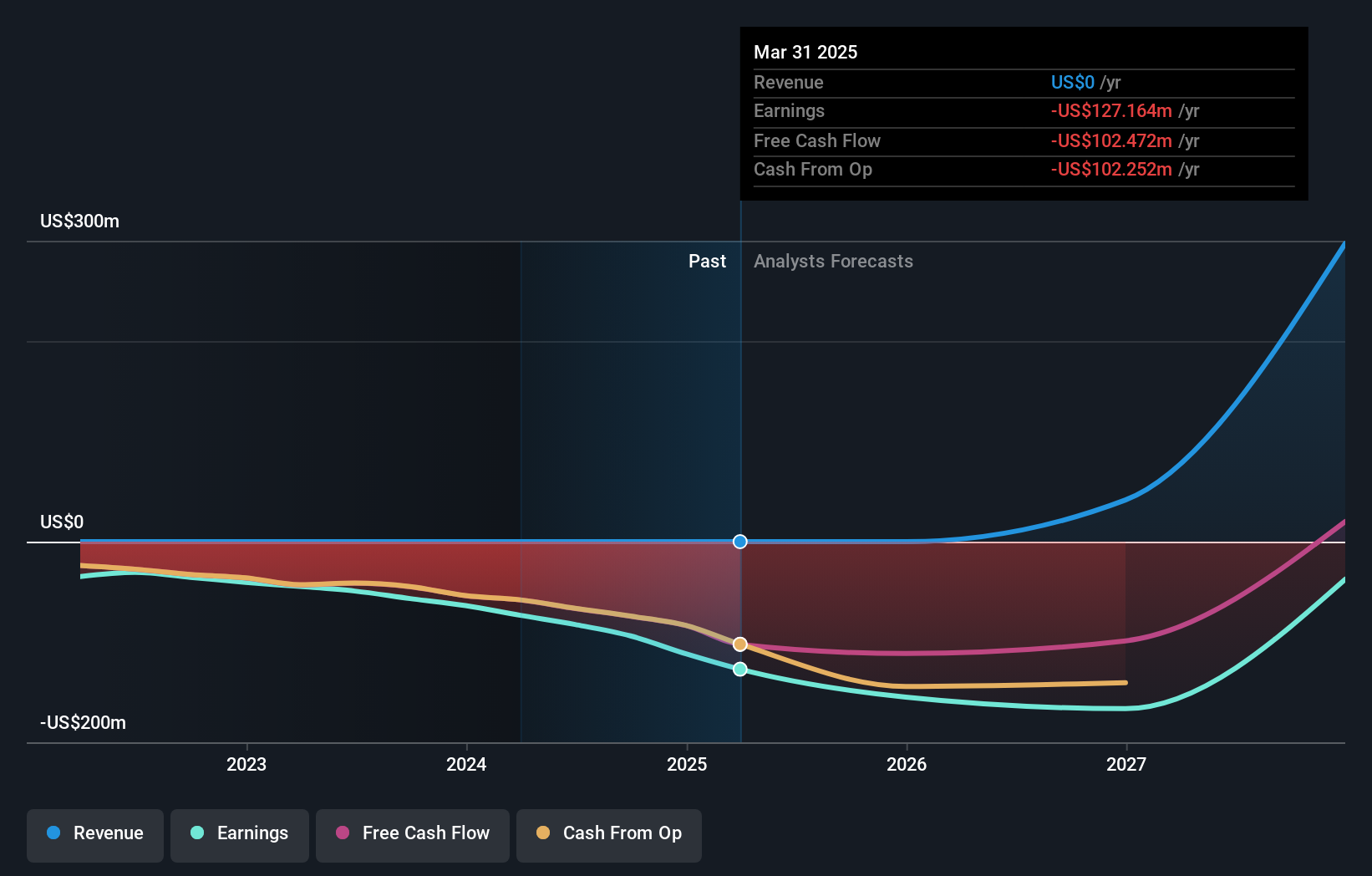

- In September 2025, Celcuity Inc. announced it had amended its senior secured credit facility with Innovatus Capital Partners and Oxford Finance, increasing its total available term loan facility to $500 million, including $350 million in committed capital and $150 million available at mutual discretion.

- This amendment enhances Celcuity’s access to capital, tying additional funding to regulatory and commercial milestones while extending repayment flexibility to support the development and potential commercialization of its lead drug candidate.

- We'll explore how access to new committed funding, particularly the milestone-based tranches, shapes Celcuity's investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Celcuity's Investment Narrative?

To be a Celcuity shareholder, you have to be confident in the company's ability to move gedatolisib through late-stage clinical development and into commercial launch, a path that is not without its financial pressures and regulatory uncertainty. The recent upsizing and amendment of Celcuity’s credit facility is clearly a significant move, given the company’s history of operating losses and lack of current revenue. Increased access to milestone-based funding provides not just more capital, but a degree of de-risking for the all-important short-term catalyst: FDA approval and subsequent commercialization of gedatolisib in advanced breast cancer. The timing and likelihood of regulatory decisions now loom even larger, as additional funds are specifically tied to FDA approval and commercial sales milestones. While dilution and high cash burn still represent clear risks, the new funding structure could meaningfully shift how soon capital shortages might threaten operations or force further equity offerings. But investors should be mindful: regulatory setbacks could still impact access to newly committed funds.

Despite retreating, Celcuity's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth over 6x more than the current price!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives