- United States

- /

- Life Sciences

- /

- NasdaqGS:CDXS

Further weakness as Codexis (NASDAQ:CDXS) drops 11% this week, taking three-year losses to 88%

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Codexis, Inc. (NASDAQ:CDXS); the share price is down a whopping 88% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 34% in the last year. Even worse, it's down 14% in about a month, which isn't fun at all. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for Codexis isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Codexis

Codexis wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Codexis grew revenue at 4.4% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 23%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

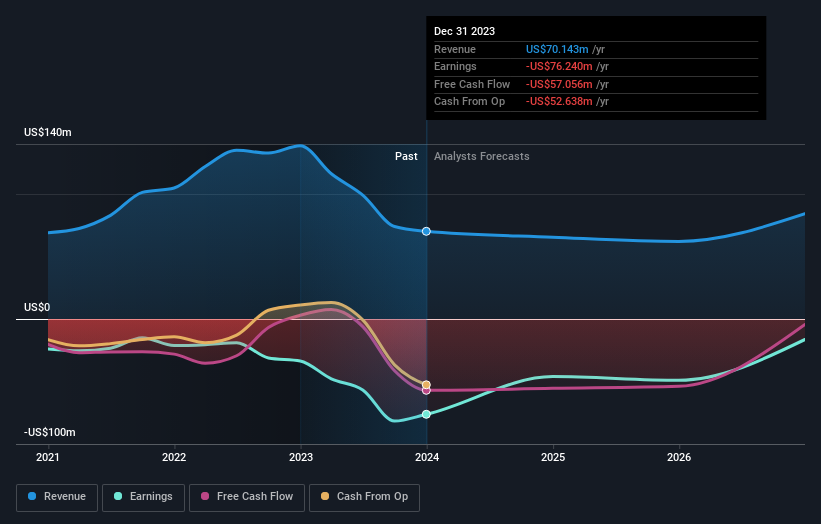

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Codexis

A Different Perspective

While the broader market gained around 25% in the last year, Codexis shareholders lost 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Codexis better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Codexis you should know about.

Codexis is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CDXS

Codexis

Provides enzymatic solutions for therapeutics manufacturing, leveraging its proprietary CodeEvolver technology platform to discover, develop, and enhance novel enzymes in the United States, Canada, Latin America, Europe, the Middle East, Africa, Australia, New Zealand, Southeast Asia, and China.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives