- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

The Market Doesn't Like What It Sees From CareDx, Inc's (NASDAQ:CDNA) Revenues Yet As Shares Tumble 26%

CareDx, Inc (NASDAQ:CDNA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 254% in the last twelve months.

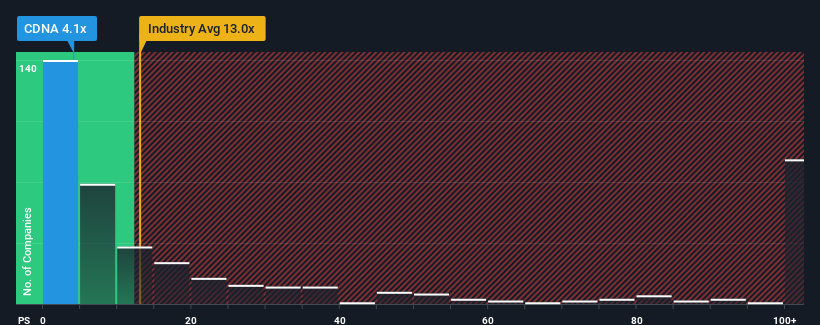

Following the heavy fall in price, CareDx may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.1x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13x and even P/S higher than 73x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CareDx

How CareDx Has Been Performing

While the industry has experienced revenue growth lately, CareDx's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CareDx will help you uncover what's on the horizon.How Is CareDx's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like CareDx's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.0% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 130% per year, which is noticeably more attractive.

With this information, we can see why CareDx is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does CareDx's P/S Mean For Investors?

Shares in CareDx have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of CareDx's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for CareDx that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives