- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

CareDx (CDNA): Profit Driven by $89.4 Million One-Off Gain Raises Earnings Sustainability Questions

Reviewed by Simply Wall St

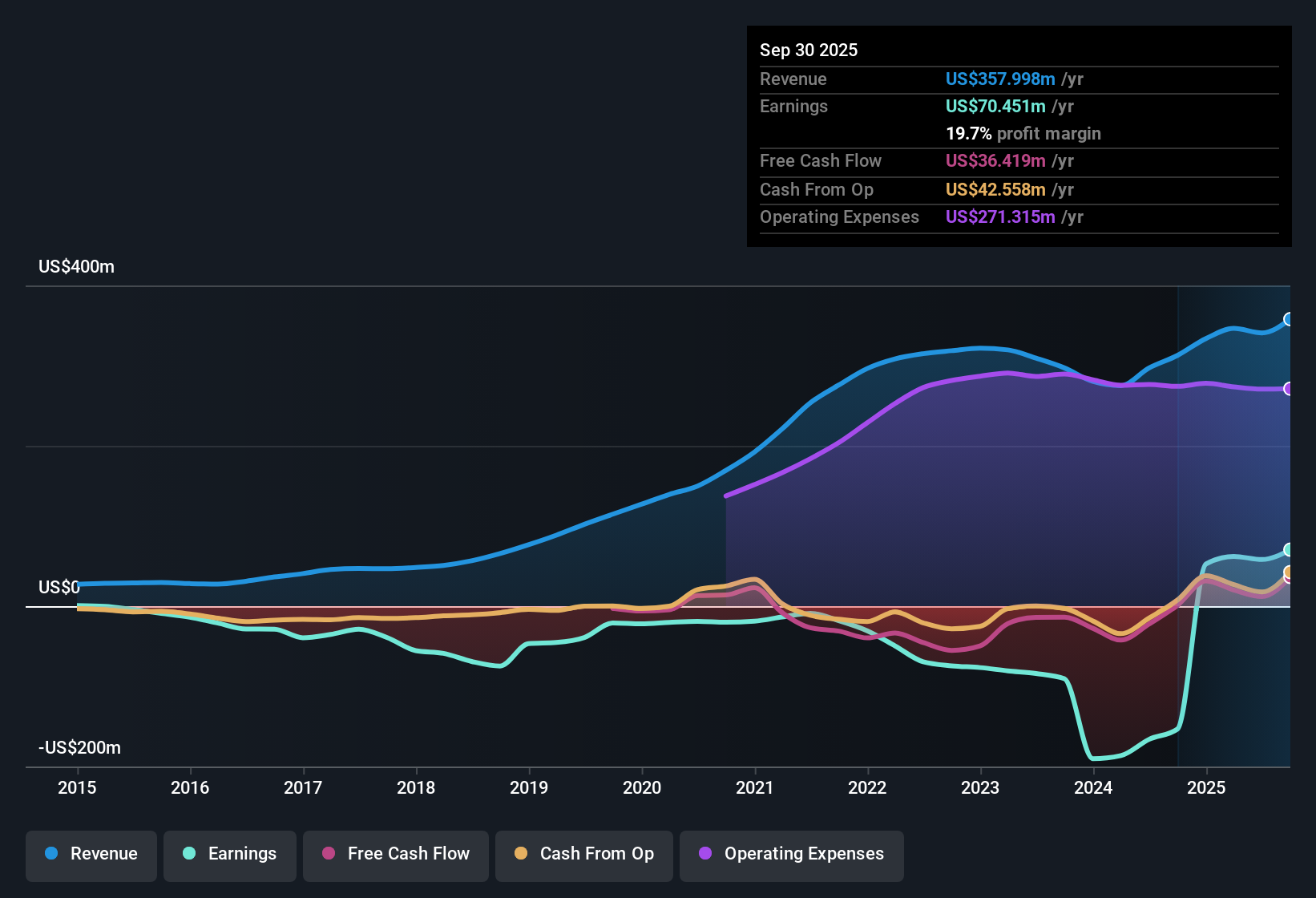

CareDx (CDNA) shifted into profitability this quarter, backed by forecasts that call for robust annual earnings growth of about 80.2% and revenue growth of 11.1% per year for the next three years. The company’s $16.53 share price and Price-To-Earnings Ratio of 15.1x compare favorably to industry and peer averages. However, the recent results were buoyed by a significant, non-recurring gain of $89.4 million. With these headline numbers and a valuation still above the estimated fair value of $5.68, investors are likely to weigh the sustainability of profitability as earnings season unfolds.

See our full analysis for CareDx.Next, we’ll see how these headline results stack up against the current market narratives, revealing which stories hold up and which might get a reality check.

See what the community is saying about CareDx

Non-Recurring Gain Skews Profit Signal

- The latest positive swing into profitability depended heavily on a one-off gain of $89.4 million, meaning recurring operations alone would not have pushed CareDx into the black.

- Analysts' consensus view highlights that, while operational improvements like expanded payer coverage and added digital health features should support future earnings stability,

- the sustainability of these profits, without similar windfalls, is still uncertain and will depend on continued revenue diversification and cost management.

- Analysts flag that enhanced recurring revenue streams and ongoing operational efficiencies need to prove themselves across future periods where such non-recurring items do not reappear.

- To see if the new profit can last beyond this quarter, read the full consensus narrative and judge for yourself. 📊 Read the full CareDx Consensus Narrative.

Peer Comparison: Price-To-Earnings Gap

- CareDx’s Price-To-Earnings Ratio stands at 15.1x, comfortably below the US Biotech peer average of 51x and the broader industry average of 16.9x, reflecting a relative value discount on this metric.

- According to the analysts' consensus narrative, this lower valuation

- is at odds with forecasts for superior revenue growth (11.1% versus the wider market) but could reflect questions about the quality and repeatability of current profits, especially given the influence of the large non-recurring gain.

- Analysts argue that while the P/E gap suggests potential upside, investors may remain cautious until core margins and earnings demonstrate consistency minus extraordinary items.

DCF Fair Value and Analyst Price Target Diverge Sharply

- The share price of $16.53 is almost triple the DCF fair value of $5.68 and still sits about 25% below the analyst price target of $21.83, showing a wide band of valuation opinions.

- Analysts' consensus view notes that achieving the price target would likely require revenue to accelerate to $485.8 million and earnings to hit $78.0 million by 2028, with margins rising to the sector average. Ongoing sector risks and recurring earnings questions could keep CareDx trading at a discount in the near term.

- This brings an opportunity for upside if bullish forecasts play out, but also exposes investors to continued valuation volatility should growth or profitability fall short of these assumptions.

- Differences between DCF fair value, analyst targets, and the market price underscore how investor optimism may be tempered by real risks in payer policy, regulatory developments, or operational execution.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CareDx on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? In just a few minutes, you can turn your insights into a personalized story. Do it your way.

A great starting point for your CareDx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

CareDx’s valuation remains lofty, and its recent profits were heavily reliant on a one-off gain. Recurring earnings and cash flows remain uncertain.

If you want fewer surprises in your investments, use our stable growth stocks screener (2074 results) to discover companies delivering consistent revenue and earnings, even when others fall short.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives