- United States

- /

- Pharma

- /

- NasdaqCM:CARA

Why Investors Shouldn't Be Surprised By Cara Therapeutics, Inc.'s (NASDAQ:CARA) Low P/S

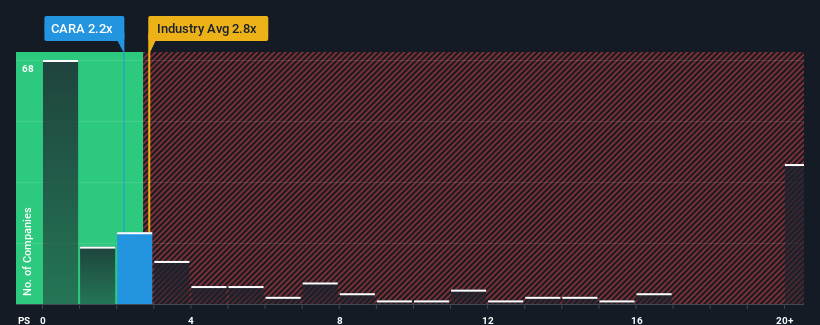

You may think that with a price-to-sales (or "P/S") ratio of 2.2x Cara Therapeutics, Inc. (NASDAQ:CARA) is a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.8x and even P/S higher than 13x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Cara Therapeutics

What Does Cara Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Cara Therapeutics' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Cara Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Cara Therapeutics?

Cara Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 61% decrease to the company's top line. As a result, revenue from three years ago have also fallen 87% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 16% per annum over the next three years. With the industry predicted to deliver 17% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that Cara Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Cara Therapeutics' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Cara Therapeutics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Cara Therapeutics' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Cara Therapeutics that you should be aware of.

If you're unsure about the strength of Cara Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CARA

Cara Therapeutics

A development-stage biopharmaceutical company, focuses on developing and commercializing therapeutics treatment of chronic pruritus in the United States.

Slight with mediocre balance sheet.

Market Insights

Community Narratives