- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics (CAPR) Is Up 477.3% After HOPE-3 Phase 3 Win for Deramiocel - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early December 2025, Capricor Therapeutics reported positive topline results from its pivotal Phase 3 HOPE-3 trial, where Deramiocel improved skeletal and cardiac function in boys and young men with Duchenne muscular dystrophy while maintaining a favorable safety profile.

- The HOPE-3 success not only answers prior FDA concerns but also strengthens the case for Deramiocel as a potential first-in-class therapy for Duchenne-related cardiomyopathy.

- We’ll now examine how HOPE-3’s successful Phase 3 outcomes for Deramiocel could reshape Capricor’s investment narrative and long-term outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Capricor Therapeutics Investment Narrative Recap

To own Capricor today, you need to believe Deramiocel can move from successful HOPE-3 data to regulatory approval and commercial use in DMD cardiomyopathy, despite past FDA hesitation. The Phase 3 win appears to materially improve the outlook for the key near term catalyst, a revised BLA submission, while the biggest risk remains Capricor’s reliance on a single late stage asset combined with ongoing cash burn and the potential for future dilution if timelines slip again.

Among recent announcements, the September 2025 BLA regulatory update now looks especially important, because it outlined the FDA’s acceptance of PUL v2.0 and LVEF as core efficacy measures that HOPE-3 has since met with statistical significance. That alignment between endpoints and data tightens the link between these new results and the path to approval, but it does not remove the broader regulatory uncertainty around cell therapies in rare diseases.

Yet even with HOPE-3’s success, investors should still be aware that Capricor’s rising R&D spend, lack of commercial revenue and potential need for fresh capital could...

Read the full narrative on Capricor Therapeutics (it's free!)

Capricor Therapeutics' narrative projects $134.4 million revenue and $14.4 million earnings by 2028.

Uncover how Capricor Therapeutics' forecasts yield a $20.60 fair value, a 31% downside to its current price.

Exploring Other Perspectives

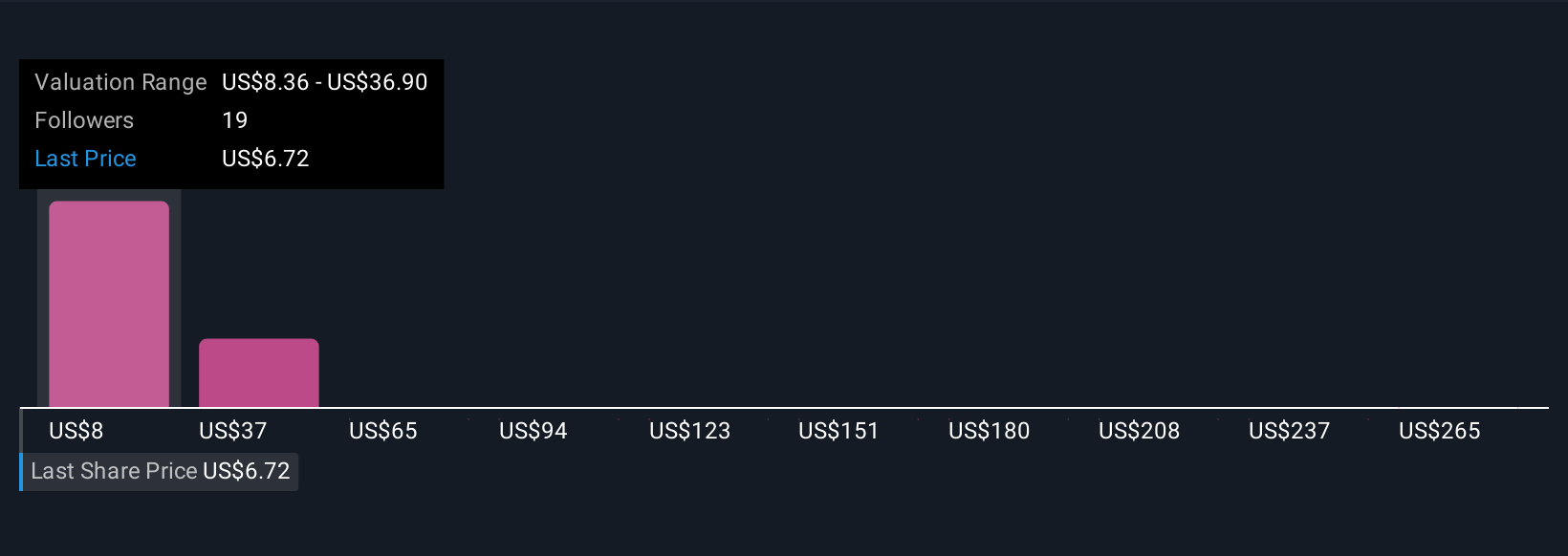

Eight members of the Simply Wall St Community value Capricor between US$8.36 and US$293.74, underscoring how far opinions can spread. Against that backdrop, the company’s dependence on Deramiocel as a single late stage asset and the regulatory scrutiny around it could have very different implications for future performance, so it is worth weighing several contrasting viewpoints before deciding how to approach the stock.

Explore 8 other fair value estimates on Capricor Therapeutics - why the stock might be worth over 9x more than the current price!

Build Your Own Capricor Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capricor Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capricor Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capricor Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026