- United States

- /

- Biotech

- /

- NasdaqGM:SLN

Spotlight On Silence Therapeutics And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 4.5%, contributing to an overall increase of 11% over the past year, with earnings forecasted to grow annually by 14%. For investors looking beyond well-known names, penny stocks—often smaller or newer companies—can present surprising opportunities. Despite being a somewhat outdated term, these stocks remain relevant as they can offer both value and growth potential when backed by strong financials and a clear growth path.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.71 | $384.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.81 | $186.38M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.175 | $198.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.31 | $54.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.56 | $88.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.50 | $20.83M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.82 | $5.85M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.33 | $75.76M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.589 | $14.59M | ✅ 3 ⚠️ 5 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.876 | $80.18M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 741 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Silence Therapeutics (NasdaqGM:SLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silence Therapeutics plc is a biotechnology company focused on developing siRNA-based therapies to target gene expression in hematology, cardiovascular, and rare diseases, with a market cap of $191.73 million.

Operations: Silence Therapeutics has not reported any specific revenue segments.

Market Cap: $191.73M

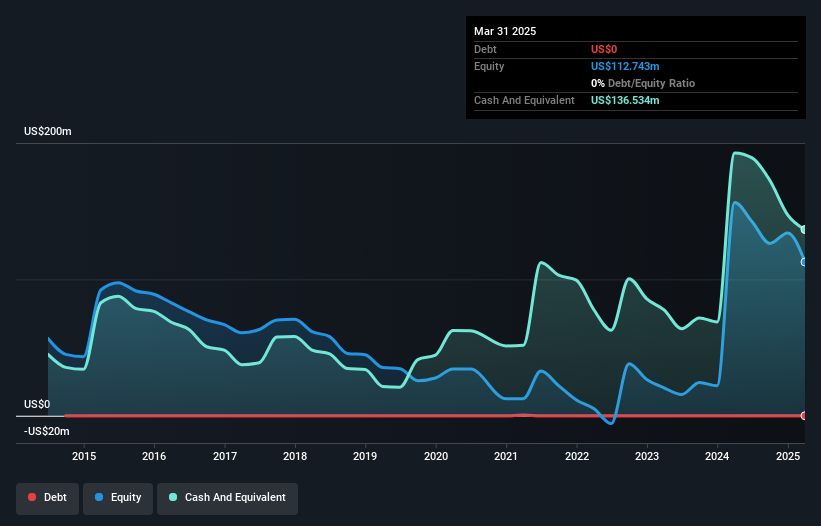

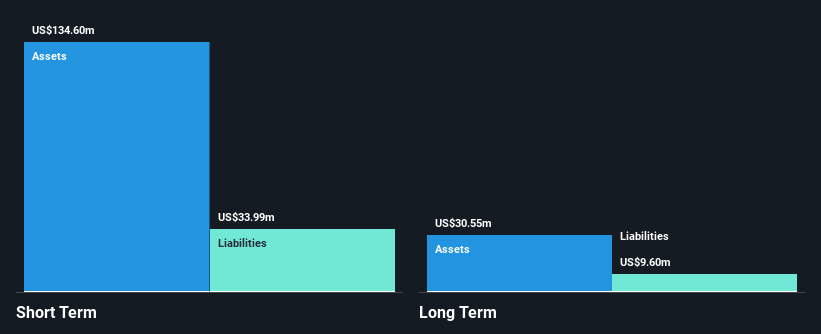

Silence Therapeutics, a pre-revenue biotech firm with a market cap of $191.73 million, has experienced significant financial volatility. Recent earnings revealed a sharp decline in sales to US$0.142 million for Q1 2025 from US$15.7 million the previous year, alongside an increased net loss of US$28.53 million. Despite being debt-free and having sufficient cash runway for over a year, the company faces challenges due to its unprofitability and volatile share price. Management changes include Tim McInerney joining as director and chair of the Remuneration Committee, potentially influencing future strategic decisions amid ongoing product development efforts.

- Dive into the specifics of Silence Therapeutics here with our thorough balance sheet health report.

- Learn about Silence Therapeutics' future growth trajectory here.

Cabaletta Bio (NasdaqGS:CABA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cabaletta Bio, Inc. is a clinical-stage biotechnology company dedicated to developing engineered T cell therapies for autoimmune diseases, with a market cap of $91.85 million.

Operations: Cabaletta Bio, Inc. currently does not report any revenue segments as it is focused on developing engineered T cell therapies for autoimmune diseases.

Market Cap: $91.85M

Cabaletta Bio, with a market cap of US$91.85 million, is a pre-revenue biotech company focused on engineered T cell therapies for autoimmune diseases. Despite its unprofitability and increasing net losses (US$35.94 million in Q1 2025), it remains debt-free with sufficient cash runway for over a year. Recent FDA support for its rese-cel therapy and RMAT designation could expedite development, though risks remain due to volatile market conditions and trial uncertainties. Upcoming clinical data presentations at the EULAR 2025 Congress may provide further insights into its therapeutic potential amidst ongoing strategic developments like share authorization increases.

- Take a closer look at Cabaletta Bio's potential here in our financial health report.

- Evaluate Cabaletta Bio's prospects by accessing our earnings growth report.

Magnachip Semiconductor (NYSE:MX)

Simply Wall St Financial Health Rating: ★★★★★★

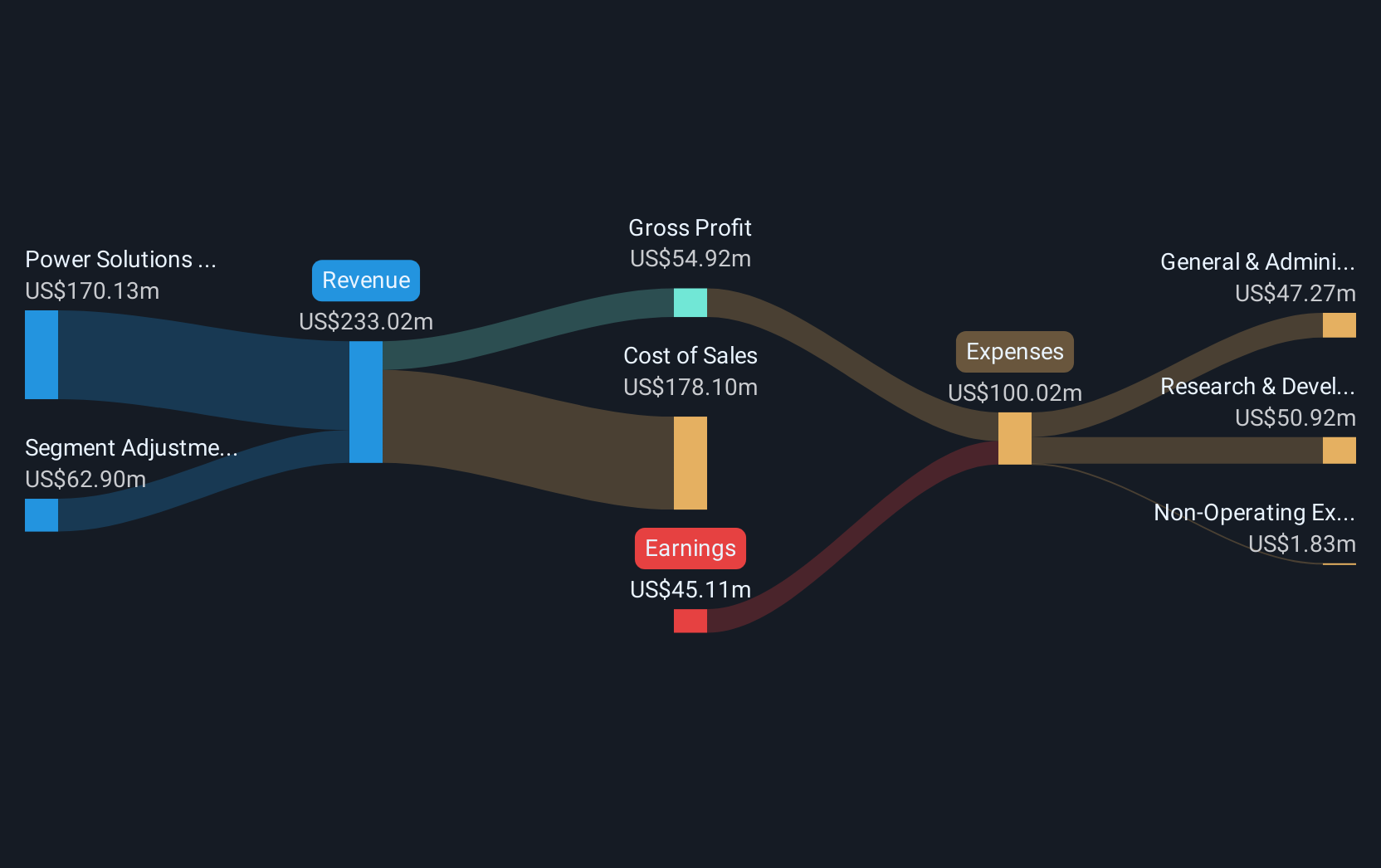

Overview: Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor solutions for various applications including communications, IoT, consumer electronics, computing, industrial, and automotive sectors with a market cap of approximately $134.62 million.

Operations: The company's revenue is primarily derived from its Standard Products Business, with $166.80 million coming from Power Analog Solutions and $54.34 million from Mixed Signal Solutions, alongside $10.60 million generated by Transitional Fab 3 Foundry Services.

Market Cap: $134.62M

Magnachip Semiconductor, with a market cap of US$134.62 million, is navigating its transition to a pure-play Power company by exiting the Display business to focus on Power Analog Solutions and Mixed Signal Solutions. The company has provided consolidated earnings guidance for Q2 2025, expecting revenue between US$45 million and US$49 million. Despite being unprofitable with increasing net losses, Magnachip's strategic shift aims at achieving profitability by 2026 through improved operational focus and product innovation like its new Gen6 IGBTs for solar inverters. The company's strong cash position exceeds its debt obligations, providing financial stability during this restructuring phase.

- Unlock comprehensive insights into our analysis of Magnachip Semiconductor stock in this financial health report.

- Gain insights into Magnachip Semiconductor's future direction by reviewing our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 741 US Penny Stocks here.

- Ready For A Different Approach? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Silence Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SLN

Silence Therapeutics

A biotechnology company, engages in the discovery and development of novel molecules incorporating short interfering ribonucleic acid (siRNA) to inhibit the expression of specific target genes in hematology, cardiovascular, and rare diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives