- United States

- /

- Biotech

- /

- NasdaqCM:EDSA

Edesa Biotech And 2 Other Promising US Penny Stocks For Your Radar

Reviewed by Simply Wall St

As the Dow Jones Industrial Average experiences a prolonged losing streak and investors closely watch Federal Reserve decisions, market participants are seeking opportunities that might weather such volatility. Penny stocks, though often seen as speculative, can still hold potential when they exhibit strong financial fundamentals. These smaller or newer companies may offer unique value propositions and growth prospects that could appeal to investors looking for under-the-radar opportunities in today's shifting economic landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.42 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.874625 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.87 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.50 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.875 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8366 | $75.59M | ★★★★★☆ |

Click here to see the full list of 716 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Edesa Biotech (NasdaqCM:EDSA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Edesa Biotech, Inc. is a clinical-stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases, with a market cap of $6.71 million.

Operations: Edesa Biotech, Inc. currently does not report any revenue segments.

Market Cap: $6.71M

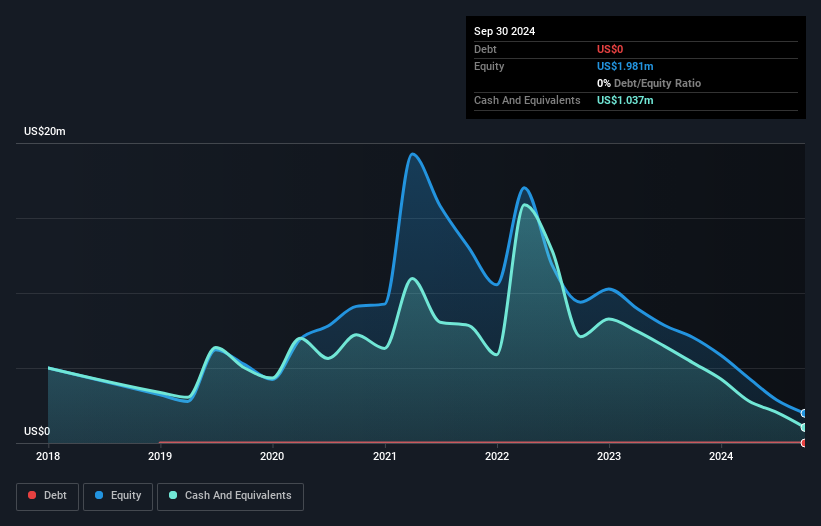

Edesa Biotech, a pre-revenue company with a market cap of US$6.71 million, faces significant challenges as highlighted by its auditor's going concern doubts. Despite having no debt and an experienced management team, the company is unprofitable with increasing losses over the past five years and forecasts indicating further earnings decline. Recent capital raises through private placements and equity offerings have temporarily extended its cash runway but shareholder dilution remains a concern. The stock's high volatility underscores investor uncertainty, compounded by an inability to achieve profitability within the next three years according to consensus estimates.

- Click here to discover the nuances of Edesa Biotech with our detailed analytical financial health report.

- Assess Edesa Biotech's future earnings estimates with our detailed growth reports.

Barinthus Biotherapeutics (NasdaqGM:BRNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Barinthus Biotherapeutics plc is a clinical-stage biopharmaceutical company focused on developing novel T cell immunotherapeutic candidates to address chronic infectious diseases, autoimmunity, and cancer, with a market cap of $36.71 million.

Operations: The company's revenue is derived entirely from its research and development activities in immunotherapies and vaccines, amounting to $14.97 million.

Market Cap: $36.71M

Barinthus Biotherapeutics, with a market cap of US$36.71 million, is a clinical-stage biopharmaceutical company focused on immunotherapies for infectious diseases and cancer. Despite reporting US$14.97 million in revenue from R&D activities, it remains unprofitable with increasing losses over the past five years. Recent executive changes saw Dr. Geoffrey Lynn appointed as Chief Scientific Officer, potentially strengthening its leadership in T-cell therapies. Preliminary data from its Phase 2a IM-PROVE II trial showed promising results for hepatitis B treatment when combined with nivolumab, although high volatility and shareholder dilution present ongoing challenges to investors' confidence.

- Jump into the full analysis health report here for a deeper understanding of Barinthus Biotherapeutics.

- Learn about Barinthus Biotherapeutics' future growth trajectory here.

Spruce Power Holding (NYSE:SPRU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Spruce Power Holding Corporation owns and operates distributed solar energy assets in the United States, with a market cap of $50.60 million.

Operations: Spruce Power Holding generates revenue from its Residential Solar Energy Systems segment, totaling $77.58 million.

Market Cap: $50.6M

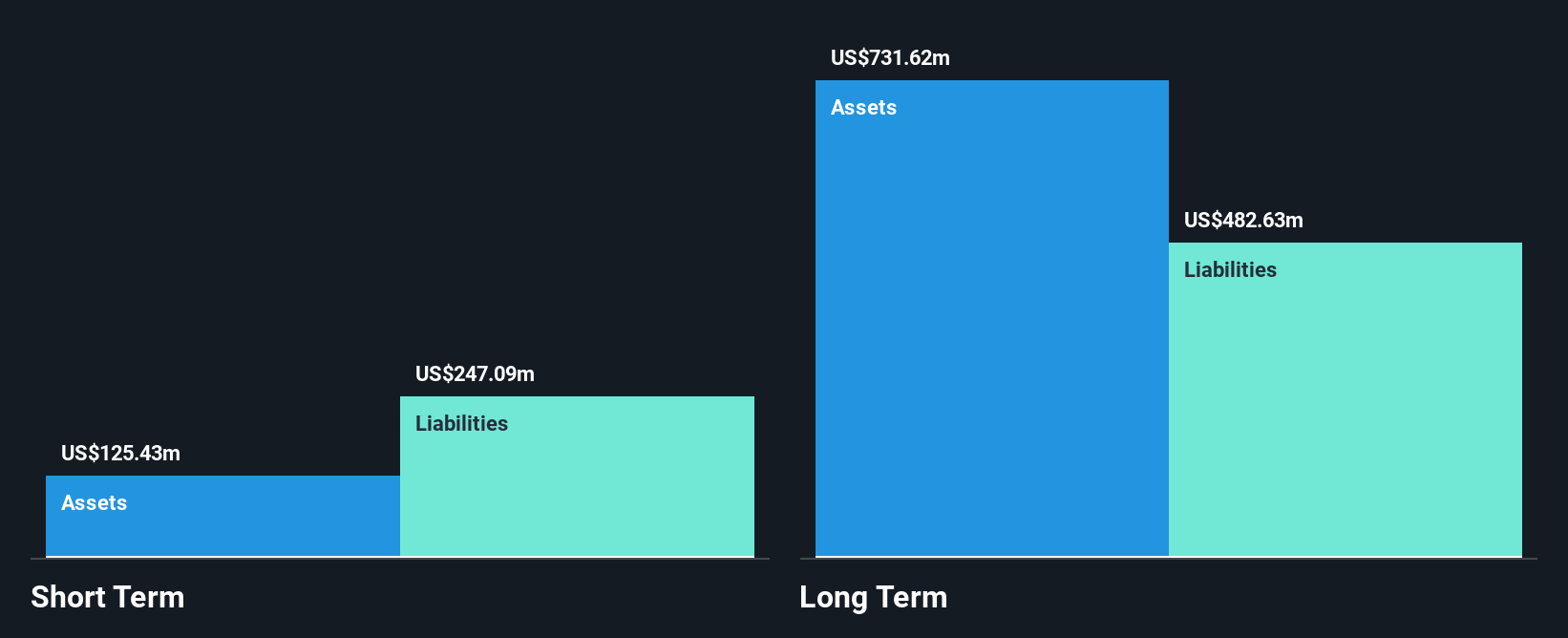

Spruce Power Holding Corporation, with a market cap of US$50.60 million, operates in the distributed solar energy sector and reported US$77.58 million in revenue from its Residential Solar Energy Systems segment. Despite improved shareholder equity and sufficient short-term asset coverage over liabilities, the company faces challenges with high net debt to equity ratio (320.2%) and increasing losses—US$53.53 million for Q3 2024 compared to US$19.31 million a year ago—with basic loss per share rising significantly to US$2.88 from US$1.11 year-on-year, indicating financial instability amidst efforts such as share buybacks under its recent repurchase program.

- Click to explore a detailed breakdown of our findings in Spruce Power Holding's financial health report.

- Gain insights into Spruce Power Holding's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Dive into all 716 of the US Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edesa Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EDSA

Edesa Biotech

A clinical-stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases.

Excellent balance sheet moderate.