- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker Corporation's (NASDAQ:BRKR) Business Is Yet to Catch Up With Its Share Price

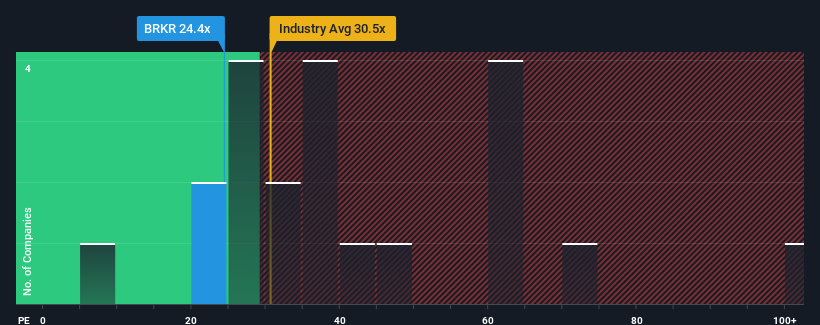

Bruker Corporation's (NASDAQ:BRKR) price-to-earnings (or "P/E") ratio of 24.4x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Bruker as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Bruker

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Bruker would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 30% gain to the company's bottom line. Pleasingly, EPS has also lifted 99% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 15% as estimated by the nine analysts watching the company. That's not great when the rest of the market is expected to grow by 13%.

In light of this, it's alarming that Bruker's P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Bruker's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Bruker that you need to take into consideration.

Of course, you might also be able to find a better stock than Bruker. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives