- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker (BRKR): Reassessing Valuation After a Sharp Three-Month Share Price Rebound

Reviewed by Simply Wall St

Recent Performance and Why Bruker Is Back on Watchlists

Bruker (BRKR) has quietly swung from a weak year to a stronger recent stretch, with the stock up about 8% over the past month and more than 40% in the past 3 months.

See our latest analysis for Bruker.

That recent 3 month share price return of 40.72% stands in sharp contrast to Bruker’s weaker year to date share price return of negative 23.26%. This suggests momentum is rebuilding as investors reassess its growth and risk profile.

If Bruker’s rebound has you thinking about what else could surprise to the upside, this is a good moment to explore healthcare stocks as potential next ideas.

With shares still below analysts’ targets despite a sharp rebound and earnings swinging from losses to rapid growth, the key question now is whether Bruker remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 7.6% Undervalued

With Bruker last closing at $45.13 against a narrative fair value near $48.83, the story leans constructive, setting up an interesting long term view.

The company's pipeline of recent innovations (e.g., next-generation tims mass spectrometry, spatial biology, automated diagnostics) positions it to benefit from sustained investment in personalized medicine, genomics, and high-throughput scientific R&D, supporting both future revenue expansion and favorable product mix improvements.

Curious how modest top line growth, rising margins, and a richer earnings multiple can still point to upside? The full narrative explains the assumptions and calculations behind that view.

Result: Fair Value of $48.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged funding headwinds in U.S. and Chinese research or slower than expected demand recovery could quickly undermine this constructive valuation narrative.

Find out about the key risks to this Bruker narrative.

Another Angle on Valuation

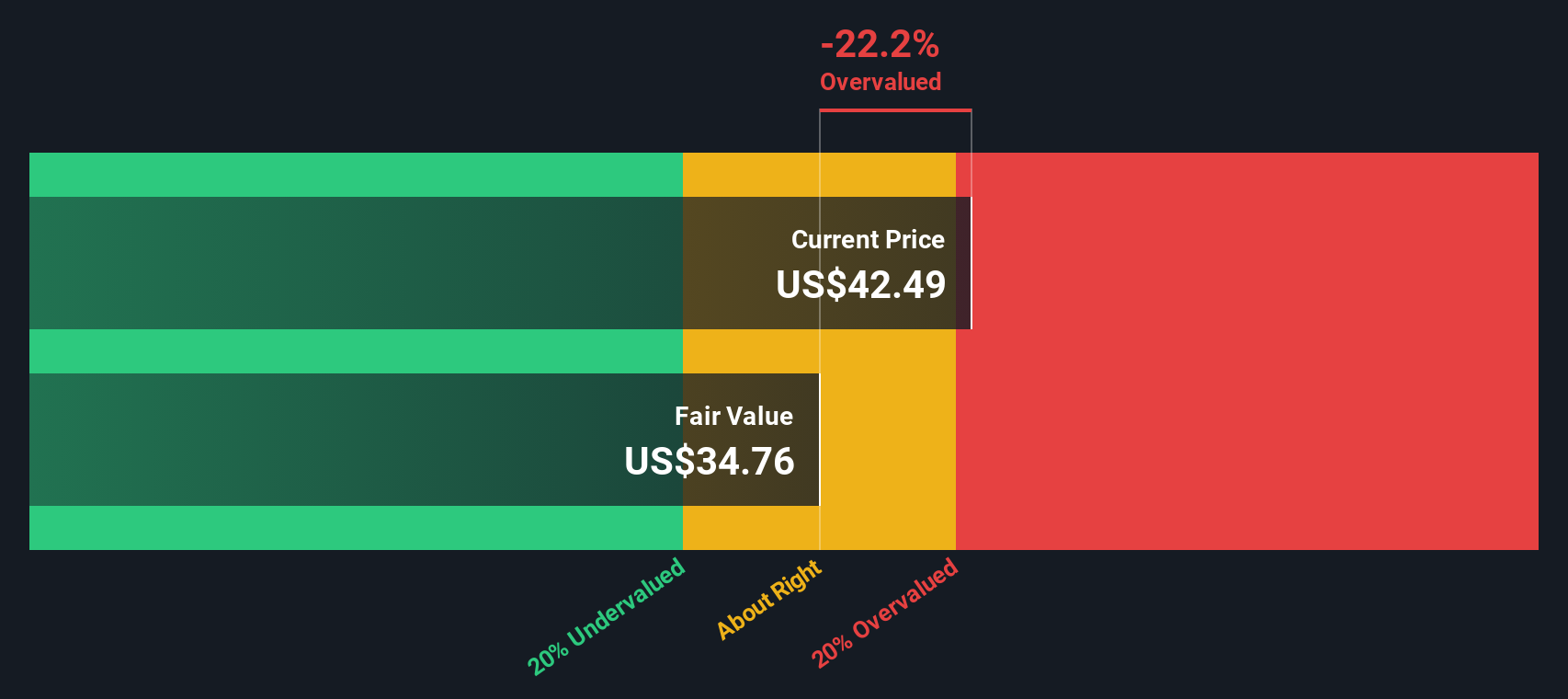

Our SWS DCF model presents a less optimistic picture than the narrative fair value. On this view, Bruker’s shares, at $45.13, sit above an estimated fair value of about $36.65, which suggests the stock may be overvalued rather than discounted. Which perspective do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bruker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bruker Narrative

If you view the numbers differently, or prefer hands on research to prebuilt views, you can assemble your own narrative in minutes. Start with Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when you can scan the market for others. Use Simply Wall Street's powerful screener to explore potential investments that match your criteria.

- Consider reviewing these 3612 penny stocks with strong financials to find companies with developing business stories, improving fundamentals, and the potential for growing institutional interest.

- Review these 26 AI penny stocks to explore businesses involved in automation, predictive analytics, and intelligent platforms that may be contributing to changes across various industries.

- Assess these 13 dividend stocks with yields > 3% to identify companies that combine dividend yields with payout ratios and cash generation that you find acceptable for your income objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)