- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker (BRKR): Exploring Current Valuation After Recent Market Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Bruker.

While Bruker's 1-month share price return of 17.21% suggests a burst of renewed confidence, the stock's longer-term performance remains challenging with a year-to-date share price decline of 38.39% and a 1-year total shareholder return of -42.58%. Recent volatility points to shifting sentiment, as investors weigh new risks and the potential for a turnaround.

If the ups and downs in Bruker’s journey have you thinking bigger, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Bruker's shares rebounding but still well below previous highs, the big question for investors is whether the recent dip has left the stock undervalued or if the market has already factored in all future growth prospects.

Most Popular Narrative: 22.5% Undervalued

Bruker’s last close of $36.23 stands well below the narrative fair value estimate of $46.73. This suggests significant upside if analyst expectations play out. This sets an intriguing backdrop for the driving forces forecasted by the most widely followed narrative, which hinges on a mix of future growth drivers and structural improvements.

The company's pipeline of recent innovations (e.g., next-generation tims mass spectrometry, spatial biology, automated diagnostics) positions it to benefit from sustained investment in personalized medicine, genomics, and high-throughput scientific R&D, supporting both future revenue expansion and favorable product mix improvements.

What backs up this valuation? The real story is a mix of bold projections and underlying margin expansions that could completely reshape Bruker’s profit profile. Some key assumptions behind this figure may surprise even the most seasoned investors. Craving the details that justify such a large gap between price and value? See which forward-looking drivers make all the difference in the full narrative.

Result: Fair Value of $46.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent funding headwinds in the US and China, or ongoing economic uncertainty, could derail Bruker's recovery and threaten earnings momentum.

Find out about the key risks to this Bruker narrative.

Another View: What Do Market Ratios Say?

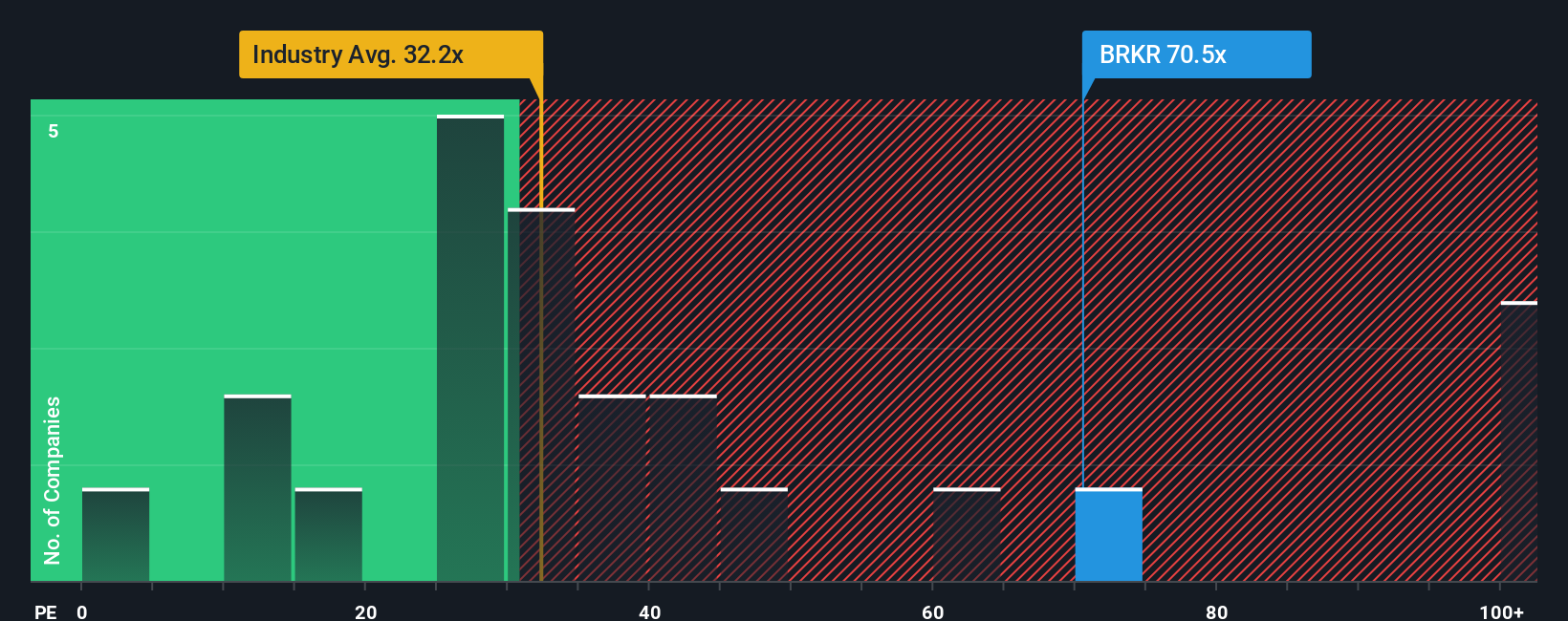

While analyst forecasts suggest Bruker is undervalued, the market's current price-to-earnings ratio of 69.1x stands well above the US Life Sciences industry average of 32.1x and the fair ratio of 39x. This wide gap could mean Bruker is priced for perfection, which may be a risky bet if growth stumbles. Which side of the debate will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bruker Narrative

If you see the story taking a different turn or want to dig into the numbers yourself, you can put together your own perspective in just a few minutes, then Do it your way

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

No savvy investor limits their search. Move ahead by targeting fresh opportunities and see what's possible beyond the familiar Bruker story.

- Jumpstart your search for steady passive income by tracking companies offering consistently strong yields through these 18 dividend stocks with yields > 3%.

- Stay ahead of the curve with a hand-picked selection of innovators excelling at artificial intelligence. Start by checking out these 25 AI penny stocks.

- Take charge of your value investing journey by finding hidden gems trading at attractive prices with these 891 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives