- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

The Bull Case For BioNTech (BNTX) Could Change Following Higher Guidance And Oncology Progress – Learn Why

Reviewed by Sasha Jovanovic

- In its recent Q3 2025 update, BioNTech reported a net loss largely tied to a contractual dispute settlement but raised full-year revenue guidance, supported by higher collaboration revenue from Bristol-Myers Squibb and progress in its late-stage oncology programs.

- The company highlighted that advancing Phase III trials for Pumitamig in lung and triple-negative breast cancer, along with plans to seek FDA approval for TPAM (BNT323) in endometrial cancer in 2026, is central to its push toward becoming a fully integrated commercial oncology business.

- We’ll now examine how higher revenue guidance driven by Bristol-Myers Squibb collaboration revenue may influence BioNTech’s evolving investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

BioNTech Investment Narrative Recap

To own BioNTech, you need to believe its pivot from COVID-19 vaccines to a diversified oncology portfolio can eventually offset current losses and heavy R&D spending. The Q3 2025 update, with higher revenue guidance helped by Bristol-Myers Squibb collaboration revenue, offers some support for that thesis, but does not change the near term reliance on successful late stage oncology outcomes or the key risk that these expensive programs may still fail.

The expanded collaboration with Bristol-Myers Squibb around BNT327, which could contribute to the higher 2025 revenue guidance, looks especially relevant here, as it underpins BioNTech’s effort to build non COVID revenue streams while its late stage assets like Pumitamig and TPAM mature. How much that collaboration can offset ongoing net losses and a forecast period of continued unprofitability remains an open question for investors watching the oncology transition.

Yet investors should also be aware that if BioNTech’s large oncology investment phase stretches longer than expected and late stage programs stumble, ...

Read the full narrative on BioNTech (it's free!)

BioNTech's narrative projects €2.8 billion revenue and €398.3 million earnings by 2028. This implies a 0.8% yearly revenue decline and a €743.1 million earnings increase from €-344.8 million today.

Uncover how BioNTech's forecasts yield a $134.78 fair value, a 40% upside to its current price.

Exploring Other Perspectives

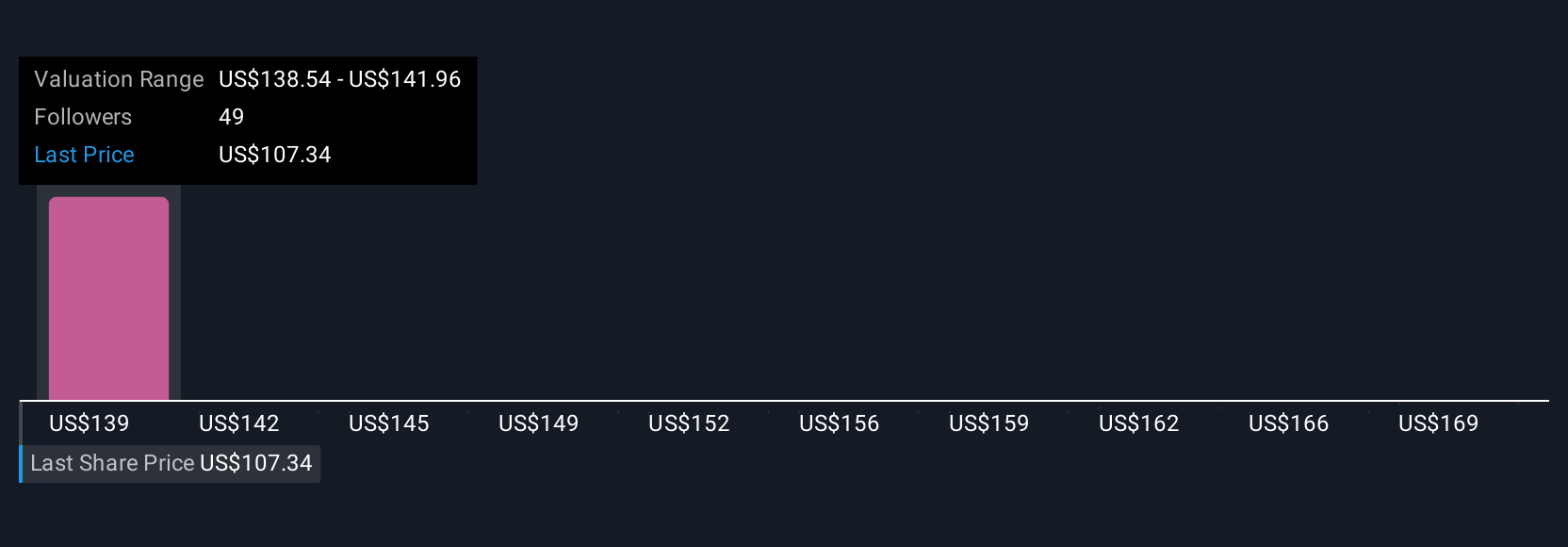

Two fair value estimates from the Simply Wall St Community cluster between US$134.78 and US$169.93 per share, showing how differently individual investors assess BioNTech. You should weigh those views against the company’s continued net losses and execution risk in its oncology pivot, which together could have a meaningful impact on how the business ultimately develops.

Explore 2 other fair value estimates on BioNTech - why the stock might be worth just $134.78!

Build Your Own BioNTech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioNTech research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free BioNTech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioNTech's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026