- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

Could BioNTech's (BNTX) AI Strategy Shift the Company’s Long-Term Innovation Narrative?

Reviewed by Sasha Jovanovic

- BioNTech recently highlighted its artificial intelligence capabilities at its Innovation Series AI Day, featuring advancements made by its subsidiary InstaDeep in drug development applications.

- The company’s ownership is highly concentrated, with private equity firms holding 43% and insiders, including the CEO, accounting for 18%, giving these groups significant influence over decision-making.

- We'll examine how BioNTech's push into AI-driven drug discovery could influence its long-term investment narrative and future pipeline prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BioNTech Investment Narrative Recap

To be a BioNTech shareholder today, you need to believe in its ability to transition from COVID-19 vaccine dependence to a sustainable future in oncology and AI-driven drug development. The recent AI Day showcasing InstaDeep’s advances is a positive signal for innovation, but it does not materially change the top short-term catalyst, late-stage clinical results in oncology, or the main risk, which remains declining COVID-19 vaccine demand.

Among several announcements, BioNTech’s recent positive Phase 3 trial readout for its LP.8.1-adapted COVID-19 vaccine for older adults stands out. While this may support near-term sentiment and revenue, the company’s long-term trajectory still relies on diversifying its pipeline beyond COVID-19 products and demonstrating commercial success in next-generation immunotherapies.

However, investors should also be aware that concentrated insider and private equity ownership brings additional complexity when it comes to ...

Read the full narrative on BioNTech (it's free!)

BioNTech's narrative projects €2.8 billion revenue and €398.3 million earnings by 2028. This requires a 0.8% annual revenue decline and an earnings increase of €743.1 million from current earnings of €-344.8 million.

Uncover how BioNTech's forecasts yield a $135.85 fair value, a 29% upside to its current price.

Exploring Other Perspectives

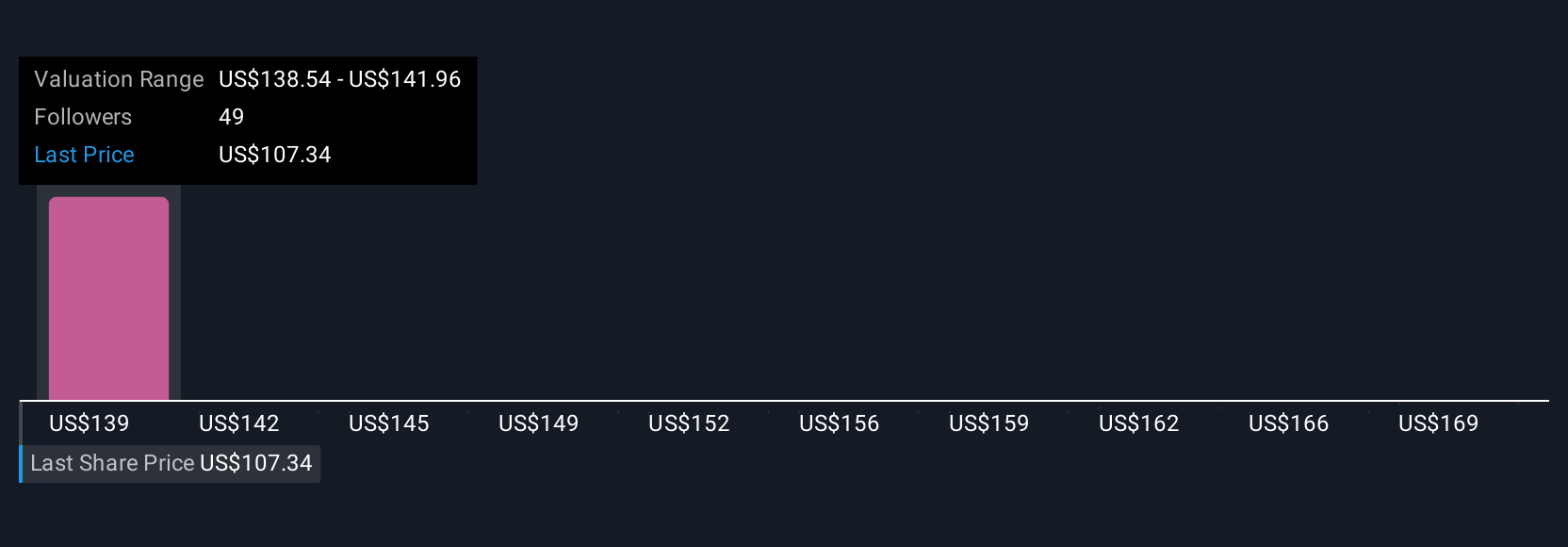

Simply Wall St Community members shared two fair value estimates for BioNTech ranging from US$135.85 to US$169.93 per share. While opinions span a wide range, the company’s ongoing heavy investment in R&D with current net losses may weigh on future outcomes, make sure you compare these viewpoints for a fuller picture.

Explore 2 other fair value estimates on BioNTech - why the stock might be worth just $135.85!

Build Your Own BioNTech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioNTech research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free BioNTech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioNTech's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives