- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

BioNTech's (NASDAQ:BNTX) Wonderful 391% Share Price Increase Shows How Capitalism Can Build Wealth

For many, the main point of investing in the stock market is to achieve spectacular returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of BioNTech SE (NASDAQ:BNTX), the share price is up an incredible 391% in the last year alone. On top of that, the share price is up 131% in about a quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for BioNTech

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year BioNTech grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 2,173% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

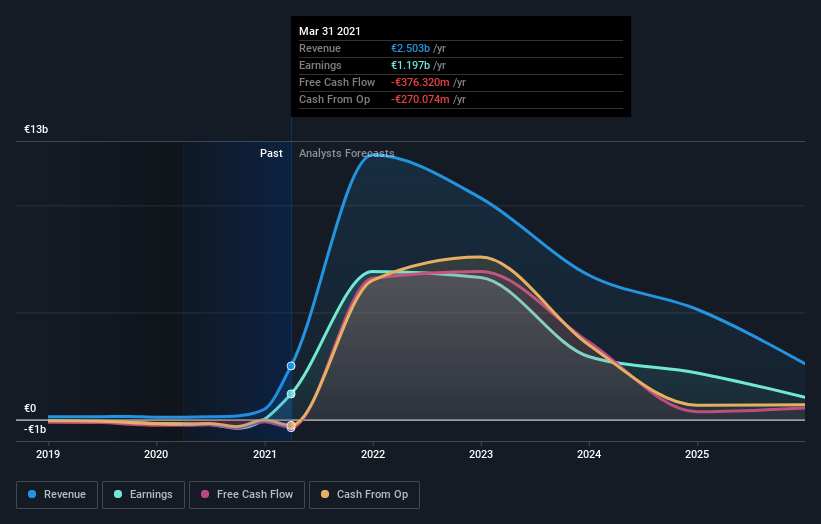

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

BioNTech is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling BioNTech stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

BioNTech boasts a total shareholder return of 391% for the last year. And the share price momentum remains respectable, with a gain of 131% in the last three months. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for BioNTech (of which 2 are concerning!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade BioNTech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives