- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

BioNTech (NASDAQ:BNTX) pulls back 3.3% this week, but still delivers shareholders incredible 44% CAGR over 5 years

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the BioNTech SE (NASDAQ:BNTX) share price. It's 507% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 34% over the last quarter. It really delights us to see such great share price performance for investors.

Since the long term performance has been good but there's been a recent pullback of 3.3%, let's check if the fundamentals match the share price.

Check out our latest analysis for BioNTech

Given that BioNTech didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, BioNTech can boast revenue growth at a rate of 26% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 43%(per year) over the same period. Despite the strong run, top performers like BioNTech have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

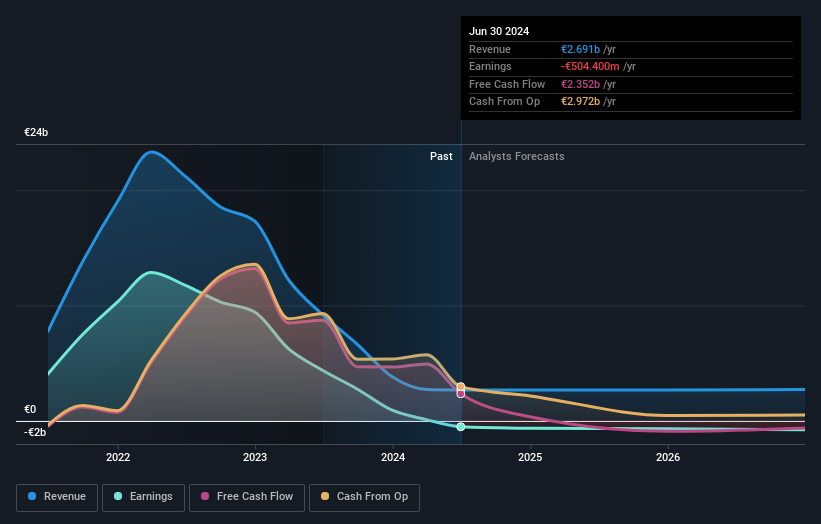

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think BioNTech will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between BioNTech's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that BioNTech's TSR, at 513% is higher than its share price return of 507%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

BioNTech shareholders gained a total return of 23% during the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 44% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for BioNTech that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives